Question: Mini-Exercise 5-5 (Static) Cost flow assumptions-FIFO and LIFO using a periodic system LO 5 7, 5-8 Sales during the year were 500 units. Beginning inventory

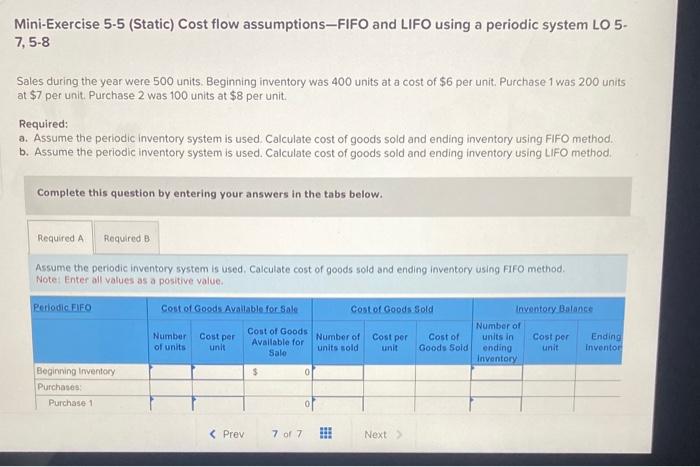

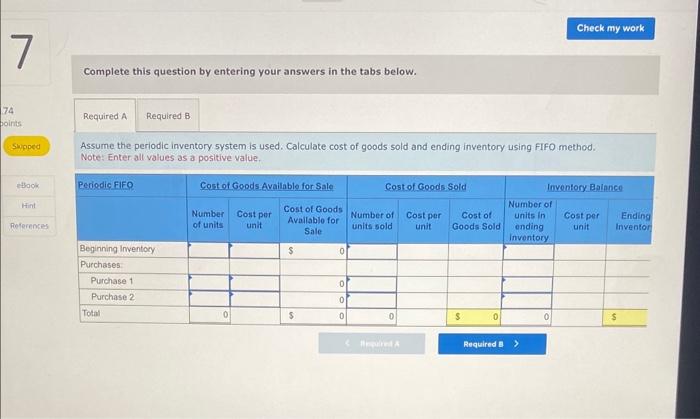

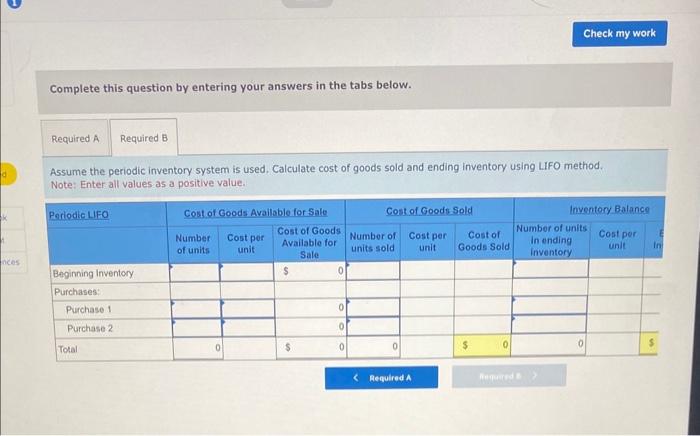

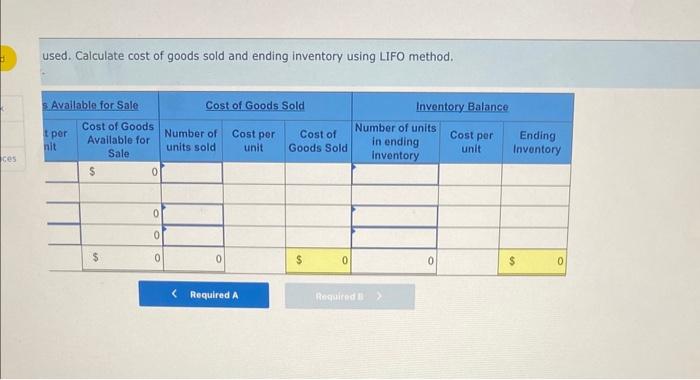

Mini-Exercise 5-5 (Static) Cost flow assumptions-FIFO and LIFO using a periodic system LO 5 7, 5-8 Sales during the year were 500 units. Beginning inventory was 400 units at a cost of $6 per unit. Purchase 1 was 200 units at $7 per unit. Purchase 2 was 100 units at $8 per unit. Required: a. Assume the periodic inventory system is used. Calculate cost of goods sold and ending inventory using FIFO method. b. Assume the periodic inventory system is used. Calculate cost of goods sold and ending inventory using LiFO method. Complete this question by entering your answers in the tabs below. Assume the periodic inventory system is used. Calculate cost of goods sold and ending inventory using fifo method. Notel Enter all values as a positive value. Complete this question by entering your answers in the tabs below. Assume the periodic inventory system is used. Calculate cost of goods sold and ending inventory using. FIFO method. Note: Enter all values as a positive value. Complete this question by entering your answers in the tabs below. Assume the periodic inventory system is used. Calculate cost of goods sold and ending inventory using LIFO method. Note: Enter all values as a positive value. used. Calculate cost of goods sold and ending inventory using LIFO method

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts