Question: Mini-Exercise 6-3 (Static) Depreciation calculation methods LO 3 Gandolfi Construction Co. purchased a CAT 336DL earth mover at a cost of $1,000,000 in January 2019

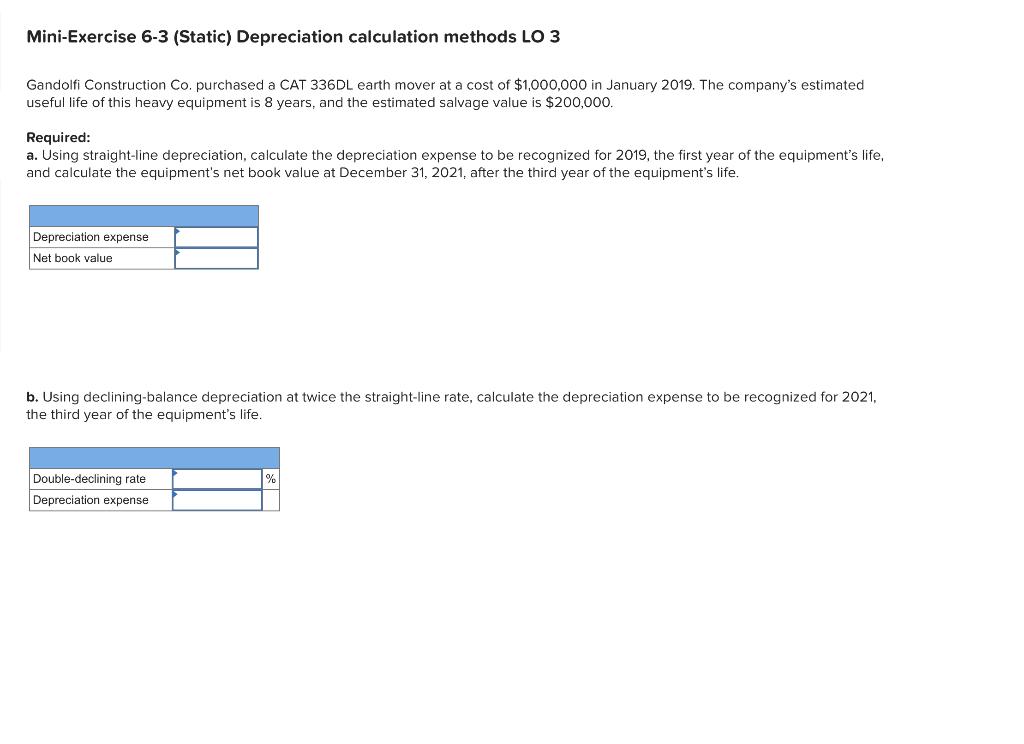

Mini-Exercise 6-3 (Static) Depreciation calculation methods LO 3 Gandolfi Construction Co. purchased a CAT 336DL earth mover at a cost of $1,000,000 in January 2019 . The company's estimated useful life of this heavy equipment is 8 years, and the estimated salvage value is $200,000. Required: a. Using straight-line depreciation, calculate the depreciation expense to be recognized for 2019, the first year of the equipment's life, and calculate the equipment's net book value at December 31, 2021, after the third year of the equipment's life. b. Using declining-balance depreciation at twice the straight-line rate, calculate the depreciation expense to be recognized for 2021 , the third year of the equipment's life

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts