Question: - minimum variance portfolio weight for ABC stock: -1.66 -6% II. Mean Variance Analysis Consider the following time series of returns for ABC stock and

- minimum variance portfolio weight for ABC stock: -1.66

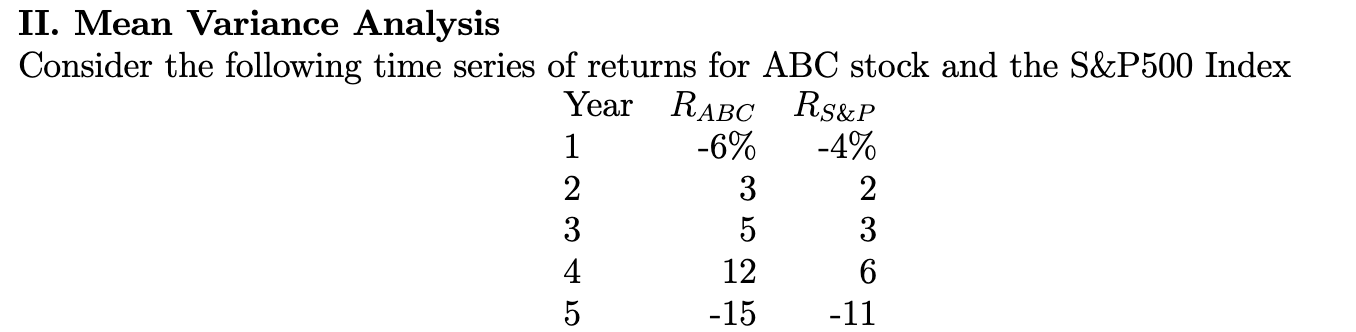

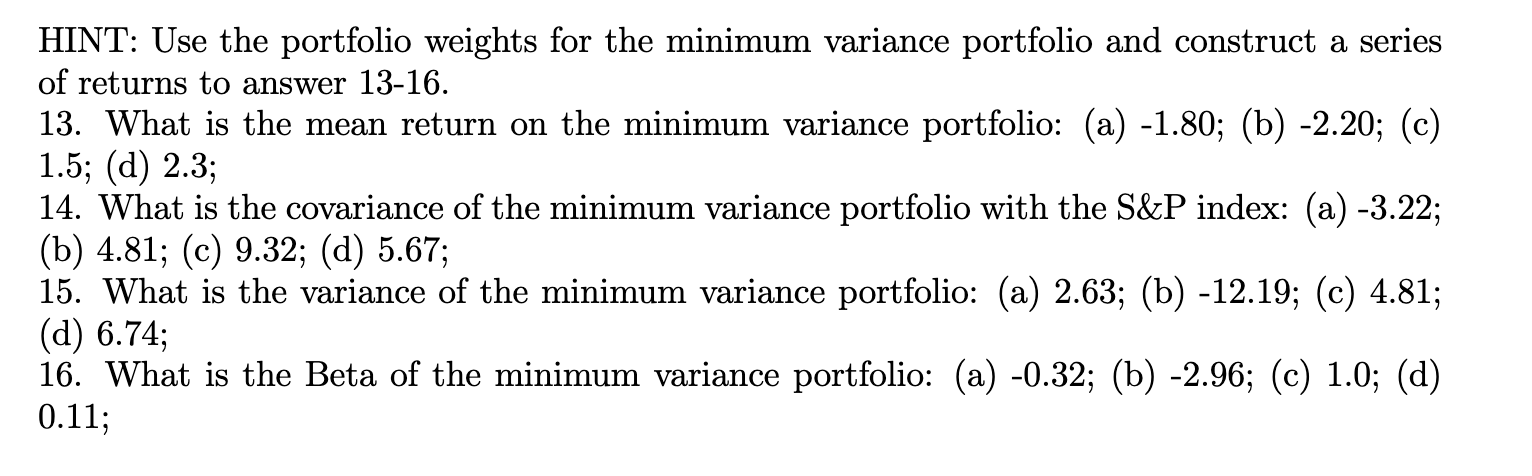

-6% II. Mean Variance Analysis Consider the following time series of returns for ABC stock and the S&P500 Index Year RABC Rs&P 1 -4% 2 3 2 3 5 3 4 12 6 5 -15 -11 s HINT: Use the portfolio weights for the minimum variance portfolio and construct a series of returns to answer 13-16. 13. What is the mean return on the minimum variance portfolio: (a) -1.80; (b) -2.20; (c) 1.5; (d) 2.3; 14. What is the covariance of the minimum variance portfolio with the S&P index: (a) -3.22; (b) 4.81; (c) 9.32; (d) 5.67; 15. What is the variance of the minimum variance portfolio: (a) 2.63; (b) -12.19; (c) 4.81; (d) 6.74; 16. What is the Beta of the minimum variance portfolio: (a) -0.32; (b) -2.96; (c) 1.0; (d) 0.11; -6% II. Mean Variance Analysis Consider the following time series of returns for ABC stock and the S&P500 Index Year RABC Rs&P 1 -4% 2 3 2 3 5 3 4 12 6 5 -15 -11 s HINT: Use the portfolio weights for the minimum variance portfolio and construct a series of returns to answer 13-16. 13. What is the mean return on the minimum variance portfolio: (a) -1.80; (b) -2.20; (c) 1.5; (d) 2.3; 14. What is the covariance of the minimum variance portfolio with the S&P index: (a) -3.22; (b) 4.81; (c) 9.32; (d) 5.67; 15. What is the variance of the minimum variance portfolio: (a) 2.63; (b) -12.19; (c) 4.81; (d) 6.74; 16. What is the Beta of the minimum variance portfolio: (a) -0.32; (b) -2.96; (c) 1.0; (d) 0.11

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts