Question: Mining project. A mining company is considering investment in exploiting land to mine for rare earth metals. The company will spend $20,000,000 immediately starting up

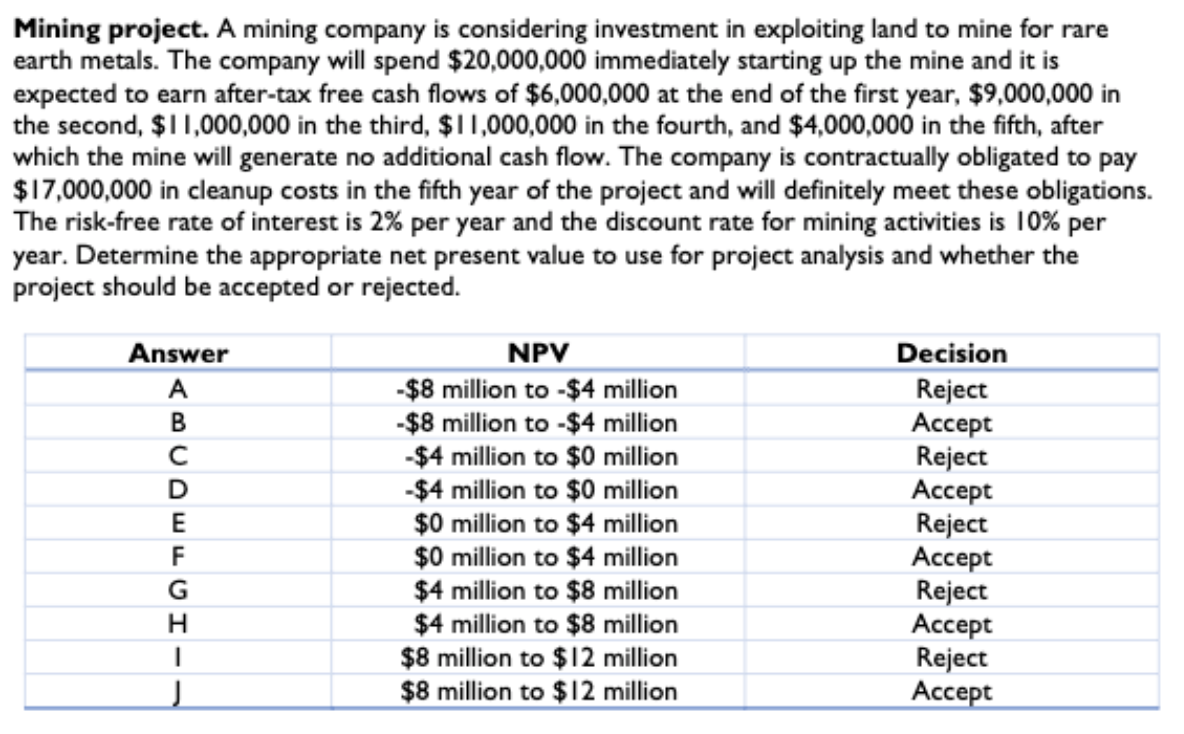

Mining project. A mining company is considering investment in exploiting land to mine for rare earth metals. The company will spend $20,000,000 immediately starting up the mine and it is expected to earn after-tax free cash flows of $6,000,000 at the end of the first year, $9,000,000 in the second, $11,000,000 in the third, $11,000,000 in the fourth, and $4,000,000 in the fifth, after which the mine will generate no additional cash flow. The company is contractually obligated to pay $17,000,000 in cleanup costs in the fifth year of the project and will definitely meet these obligations. The risk-free rate of interest is 2% per year and the discount rate for mining activities is 10% per year. Determine the appropriate net present value to use for project analysis and whether the project should be accepted or rejected. Answer A B UwLUI- NPV -$8 million to - $4 million -$8 million to-$4 million -$4 million to $0 million $4 million to $0 million $0 million to $4 million $0 million to $4 million $4 million to $8 million $4 million to $8 million $8 million to $12 million $8 million to $12 million Decision Reject Accept Reject Accept Reject Accept Reject Accept Reject Accept

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts