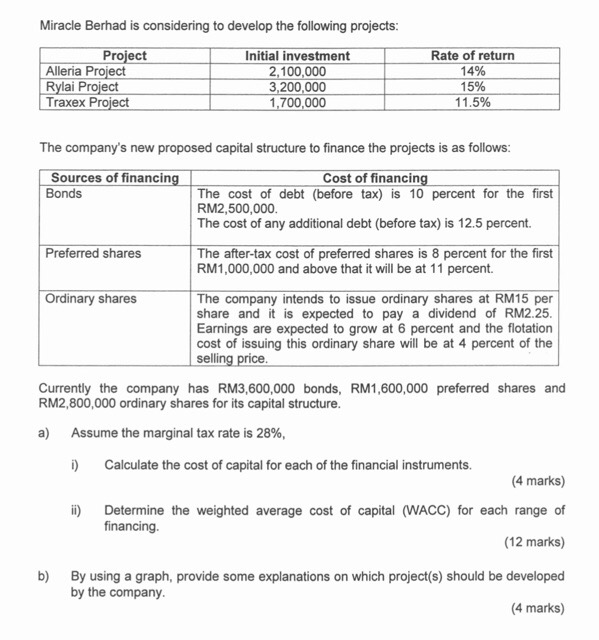

Question: Miracle Berhad is considering to develop the following projects: Project Initial investment Alleria Project 2,100,000 Rylai Project 3,200,000 | Traxex Project 1,700,000 Rate of return

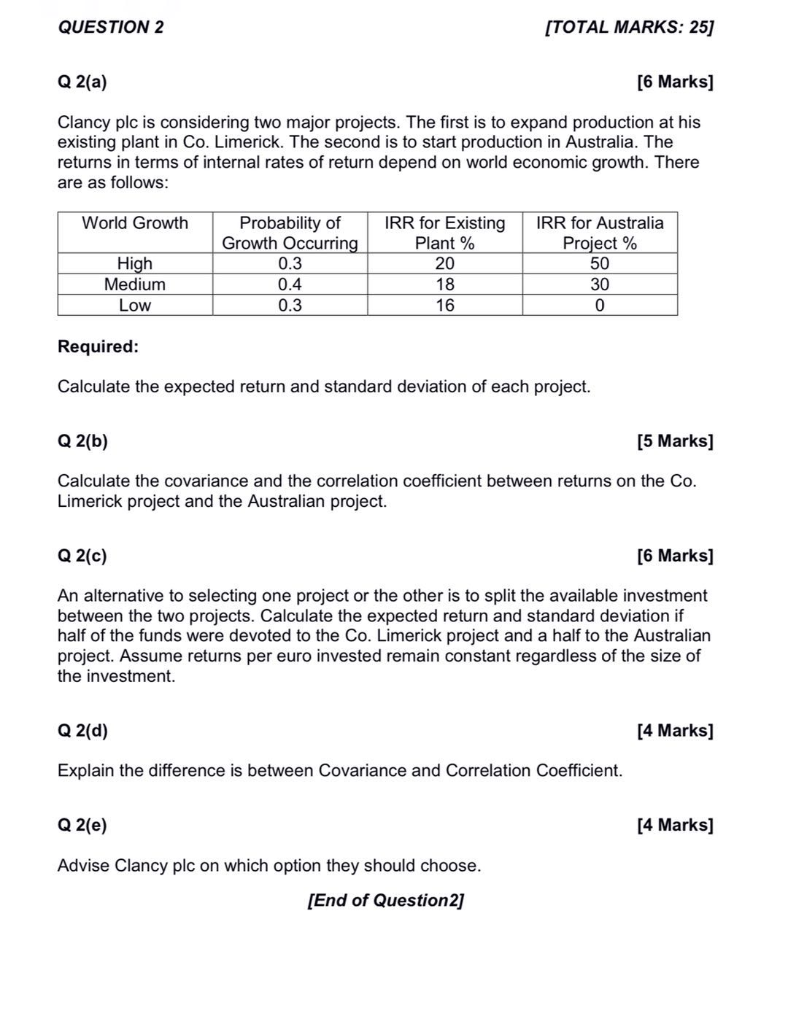

Miracle Berhad is considering to develop the following projects: Project Initial investment Alleria Project 2,100,000 Rylai Project 3,200,000 | Traxex Project 1,700,000 Rate of return 14% 15% 11.5% The company's new proposed capital structure to finance the projects is as follows: Sources of financing Cost of financing Bonds The cost of debt (before tax) is 10 percent for the first RM2,500,000 The cost of any additional debt (before tax) is 12.5 percent. Preferred shares The after-tax cost of preferred shares is 8 percent for the first RM1,000,000 and above that it will be at 11 percent Ordinary shares The company intends to issue ordinary shares at RM15 per share and it is expected to pay a dividend of RM2.25. Earnings are expected to grow at 6 percent and the flotation cost of issuing this ordinary share will be at 4 percent of the selling price. Currently the company has RM3,600,000 bonds, RM1,600,000 preferred shares and RM2,800,000 ordinary shares for its capital structure. a) Assume the marginal tax rate is 28%, ) Calculate the cost of capital for each of the financial instruments. (4 marks) ii) Determine the weighted average cost of capital (WACC) for each range of financing (12 marks) b) By using a graph, provide some explanations on which project(s) should be developed by the company. (4 marks) QUESTION 2 [TOTAL MARKS: 25] Q 2(a) [6 Marks] Clancy plc is considering two major projects. The first is to expand production at his existing plant in Co. Limerick. The second is to start production in Australia. The returns in terms of internal rates of return depend on world economic growth. There are as follows: World Growth High Medium Low Probability of Growth Occurring 0.3 0.4 0.3 IRR for Existing Plant % 20 18 16 IRR for Australia Project % 50 30 0 Required: Calculate the expected return and standard deviation of each project. Q 2(b) [5 Marks] Calculate the covariance and the correlation coefficient between returns on the Co. Limerick project and the Australian project. Q2(c) [6 Marks] An alternative to selecting one project or the other is to split the available investment between the two projects. Calculate the expected return and standard deviation if half of the funds were devoted to the Co. Limerick project and a half to the Australian project. Assume returns per euro invested remain constant regardless of the size of the investment. Q 2(d) [4 Marks] Explain the difference is between Covariance and Correlation coefficient. Q 2(e) [4 Marks] Advise Clancy plc on which option they should choose. [End of Question 2]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts