Question: mn giup e vs ah H&P plc has a total assets value of USD 400 million, of which USD300 million is financed by the shareholders'

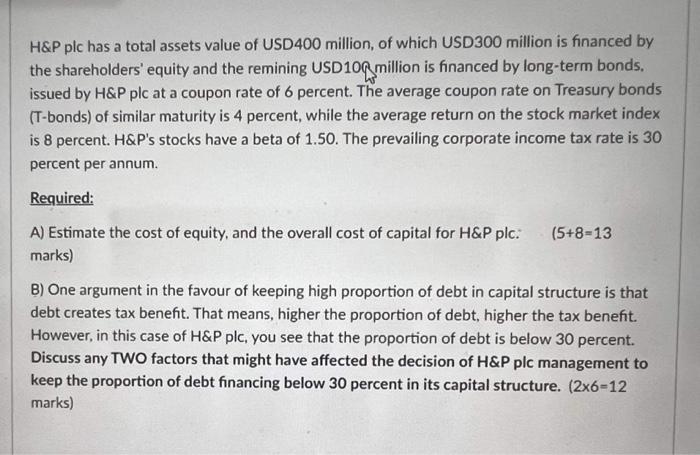

H\&P plc has a total assets value of USD 400 million, of which USD300 million is financed by the shareholders' equity and the remining USD10q million is financed by long-term bonds, issued by H\&P plc at a coupon rate of 6 percent. The average coupon rate on Treasury bonds (T-bonds) of similar maturity is 4 percent, while the average return on the stock market index is 8 percent. H\&P's stocks have a beta of 1.50. The prevailing corporate income tax rate is 30 percent per annum. Required: A) Estimate the cost of equity, and the overall cost of capital for H&P plc: (5+8=13 marks) B) One argument in the favour of keeping high proportion of debt in capital structure is that debt creates tax benefit. That means, higher the proportion of debt, higher the tax benefit. However, in this case of H\&P plc, you see that the proportion of debt is below 30 percent. Discuss any TWO factors that might have affected the decision of H\&P plc management to keep the proportion of debt financing below 30 percent in its capital structure. ( 26=12 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts