Question: Perform a financial analysis for a project using the format provided in Figure 4-5. Assume that the projected costs and benefits for this project are

Perform a financial analysis for a project using the format provided in Figure 4-5. Assume that the projected costs and benefits for this project are spread over four years as follows: Estimated costs are $300,000 in Year 1 and $40,000 each year in Years 2, 3, and 4. Estimated benefits are $0 in Year 1 and $120,000 each year in Years 2, 3, and 4. Use a 7 percent discount rate, and round the discount factors to two decimal places. Create a spreadsheet or use the business case financials template on the Companion website to calculate and clearly display the NPV, ROI, and year in which payback occurs. In addition, write a paragraph explaining whether you would recommend investing in this project, based on your financial analysis.

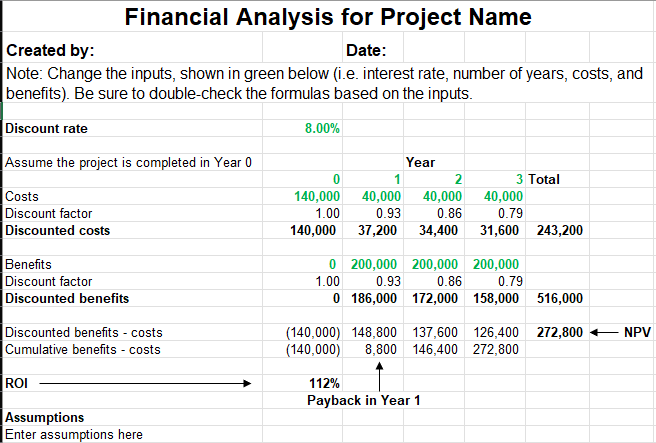

Fig 4-5:

Financial Analysis for Project Name Created by: Date: Note: Change the inputs, shown in green below (i.e. interest rate, number of years, costs, and benefits). Be sure to double-check the formulas based on the inputs. Discount rate 8.00% Assume the project is completed in Year 0 Costs Discount factor Discounted costs \begin{tabular}{|r|r|r|r|l|} \hline & \multicolumn{2}{|c|}{ Year } & & \\ \hline 0 & 1 & 2 & 3 & Total \\ \hline 140,000 & 40,000 & 40,000 & 40,000 & \\ \hline 1.00 & 0.93 & 0.86 & 0.79 & \\ \hline 140,000 & 37,200 & 34,400 & 31,600 & 243,200 \\ \hline \end{tabular} Benefits Discount factor \begin{tabular}{|c|c|r|r|} \hline 0 & 200,000 & 200,000 & 200,000 \\ \hline 1.00 & 0.93 & 0.86 & 0.79 \\ \hline \end{tabular} Discounted benefits Discounted benefits - costs \begin{tabular}{|r|r|r|r|r|} \hline(140,000) & 148,800 & 137,600 & 126,400 & 272,800 NPV \\ \hline(140,000) & 8,800 & 146,400 & 272,800 & \end{tabular} ROI112%PaybackinYear1 Assumptions Enter assumptions here

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts