Question: MNC provides customized engineering services to large manufacturing companies and uses a job-order costing system. The system provided the following information: MNC purchases materials as

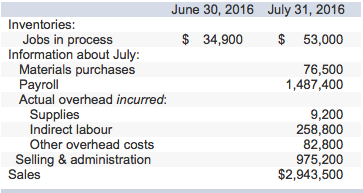

MNC provides customized engineering services to large manufacturing companies and uses a job-order costing system. The system provided the following information:

MNC purchases materials as needed and consumes them during the accounting period. Therefore, it does not need to maintain a materials inventory account. The payroll amount includes salaries/wages paid to professional (direct) labour as well as indirect labour. Overhead is allocated to jobs using a predetermined overhead allocation rate based on professional labour costs computed at the beginning of the year. For 2016, MNC estimated its professional labour and overhead amounts to be $3.2 million and $768,000 respectively.

| Required: | |

| 1. | Compute the predetermined overhead allocation rate for the year. |

![]()

| 2. | Compute the following amounts for the month of July: |

Inventories: Jobs in process Information about July: Materials purchases Payroll Actual overhead incurred: Supplies Indirect labour Other overhead costs Selling & administration Sales June 30, 2016 July 31, 2016 $ 34,900 $ 53,000 76,500 1,487,400 9,200 258,800 82,800 975,200 $2,943,500 Predetermined overhead allocation rate % of direct labour cost a. Cost of jobs completed b. Gross profit c. Net income

Step by Step Solution

3.39 Rating (158 Votes )

There are 3 Steps involved in it

To solve this problem lets tackle it step by step Step 1 Compute the Predetermined Overhead Allocati... View full answer

Get step-by-step solutions from verified subject matter experts