Question: MO Question 5 Not complete Computing Amortization of Pension Gain/Loss Everglade Co. reported the following balances related to its noncontributory defined pension plan. Account Balance

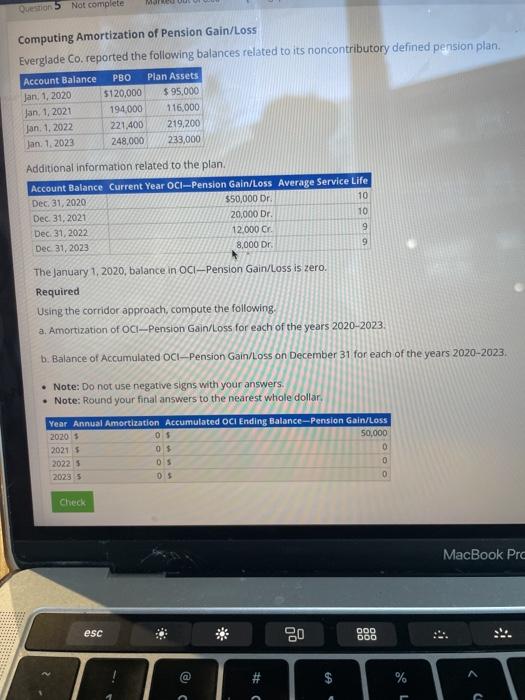

MO Question 5 Not complete Computing Amortization of Pension Gain/Loss Everglade Co. reported the following balances related to its noncontributory defined pension plan. Account Balance PBO Plan Assets Jan 1, 2020 $120,000 $ 95,000 Jan 1, 2021 194,000 116.000 Jan 1, 2022 221,400 219,200 Jan. 1.2023 248.000 233,000 Additional information related to the plan. Account Balance Current Year OCI-Pension Gain/Loss Average Service Life Dec 31, 2020 $50,000 Dr 10 Dec 31, 2021 20,000 Dr. 10 Dec 31, 2022 12,000 C 9 Dec 31, 2023 8,000 Dr. 9 The January 1, 2020, balance in OCI--Pension Gain/Loss is zero. Required Using the corridor approach, compute the following. a. Amortization of OCI-Pension Gain/Loss for each of the years 2020-2023 b. Balance of Accumulated OCI-Pension Gain/Loss on December 31 for each of the years 2020-2023 Note: Do not use negative signs with your answers. Note: Round your final answers to the nearest whole dollar Year Annual Amortization Accumulated OCI Ending Balance-Pension Gain/Loss 2020 $ Os 50,000 20215 0$ 0 20225 DS 0 2023 5 DS 0 Check MacBook Pro esc DOO :i .. # $ %

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts