Question: Please Explain all Steps!! Computing Amortization of Pension Gain/Loss Everglade Co. reported the following balances related to its noncontributory defined pension plan. Account Balance PBO

Please Explain all Steps!!

Please Explain all Steps!!

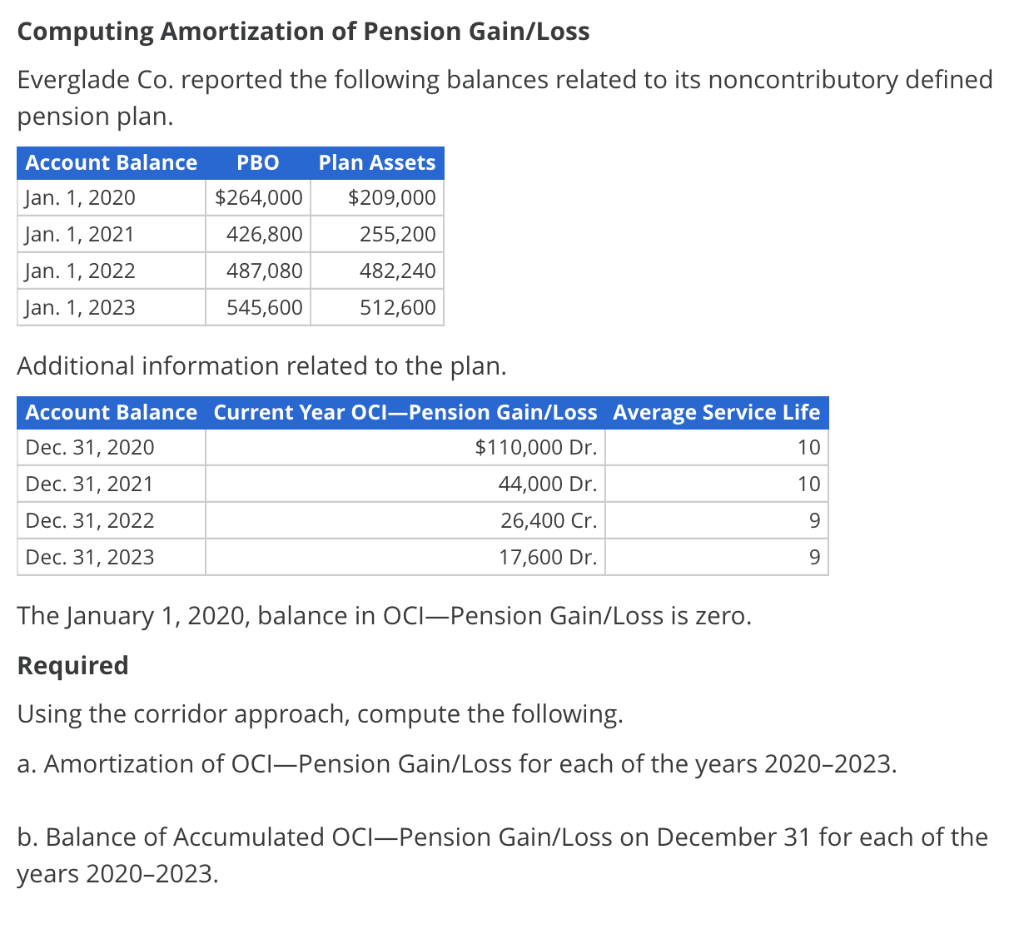

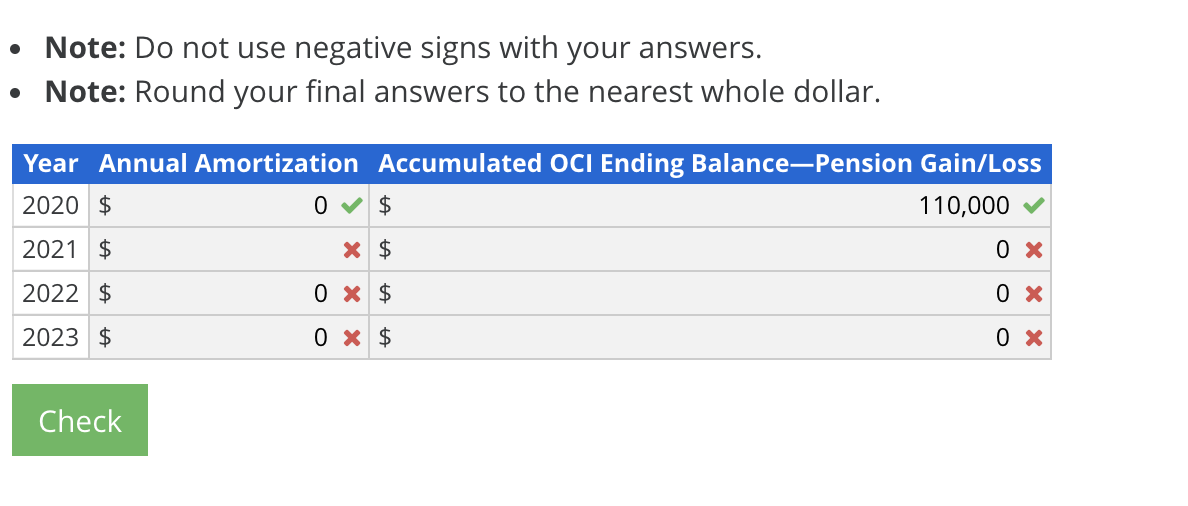

Computing Amortization of Pension Gain/Loss Everglade Co. reported the following balances related to its noncontributory defined pension plan. Account Balance PBO Plan Assets Jan. 1, 2020 Jan. 1, 2021 Jan. 1, 2022 Jan. 1, 2023 $264,000 426,800 487,080 545,600 $209,000 255,200 482,240 512,600 Additional information related to the plan. Account Balance Current Year OCIPension Gain/Loss Average Service Life Dec. 31, 2020 $110,000 Dr. 10 Dec. 31, 2021 44,000 Dr. 10 Dec. 31, 2022 26,400 Cr. 9 Dec. 31, 2023 17,600 Dr. 9 The January 1, 2020, balance in OCIPension Gain/Loss is zero. Required Using the corridor approach, compute the following. a. Amortization of OCIPension Gain/Loss for each of the years 2020-2023. b. Balance of Accumulated OCI-Pension Gain/Loss on December 31 for each of the years 2020-2023. Note: Do not use negative signs with your answers. Note: Round your final answers to the nearest whole dollar. Year Annual Amortization Accumulated OCI Ending Balance-Pension Gain/Loss 2020 $ 0 $ 110,000 2021 $ X $ 0 x 2022 $ 0 x $ 0 x 2023 $ 0 X $ 0 x Check

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts