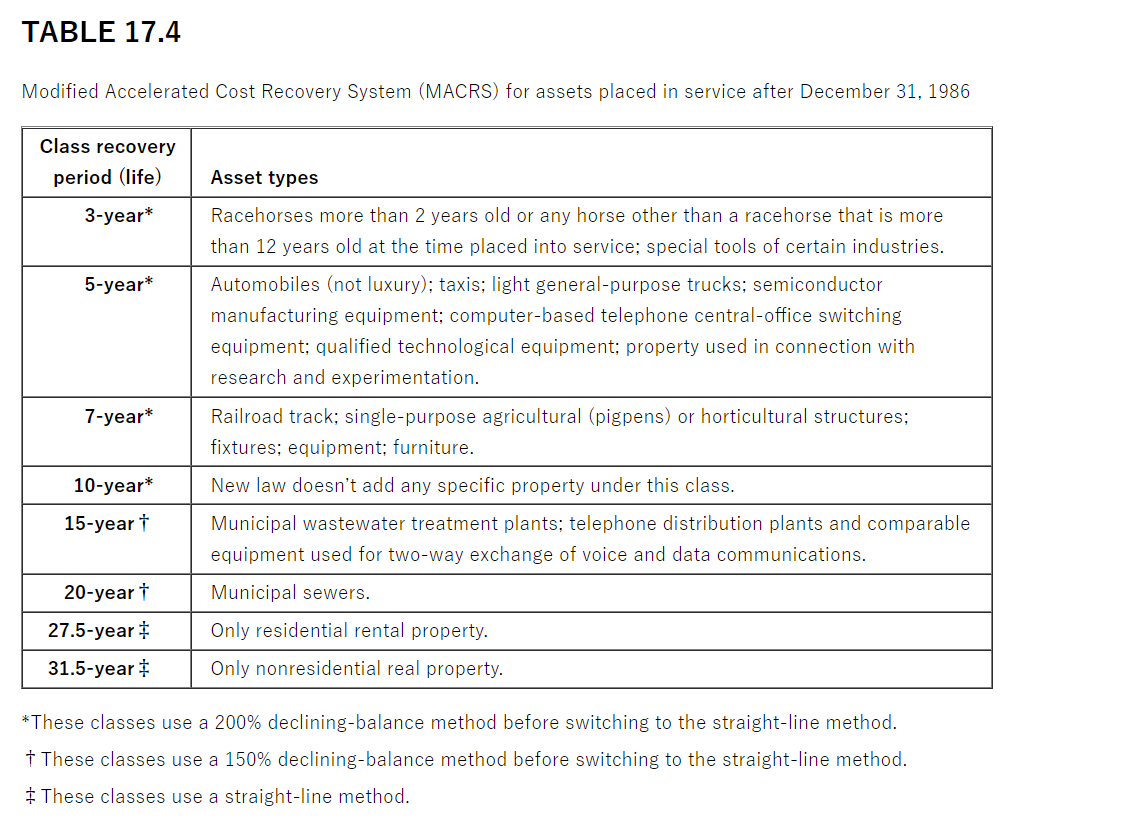

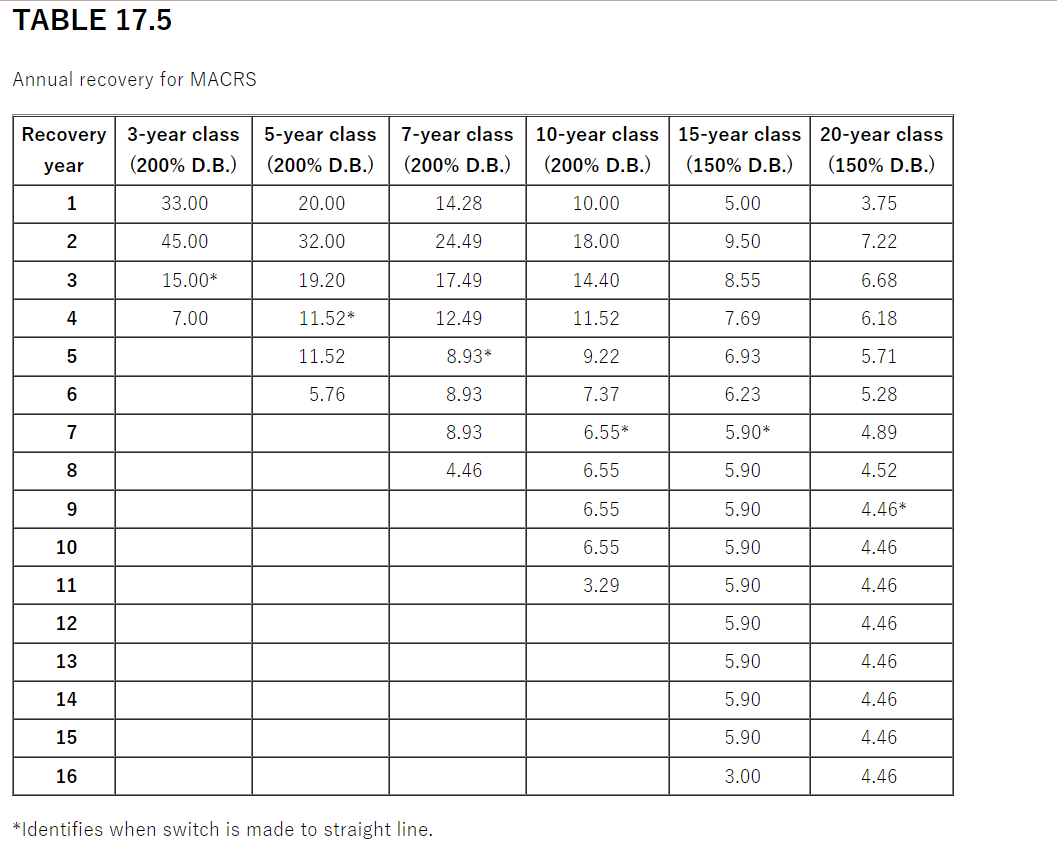

Question: Modified Accelerated Cost Recovery System (MACRS) for assets placed in service after December 31, 1986 These classes use a 150% declining-balance method before switching to

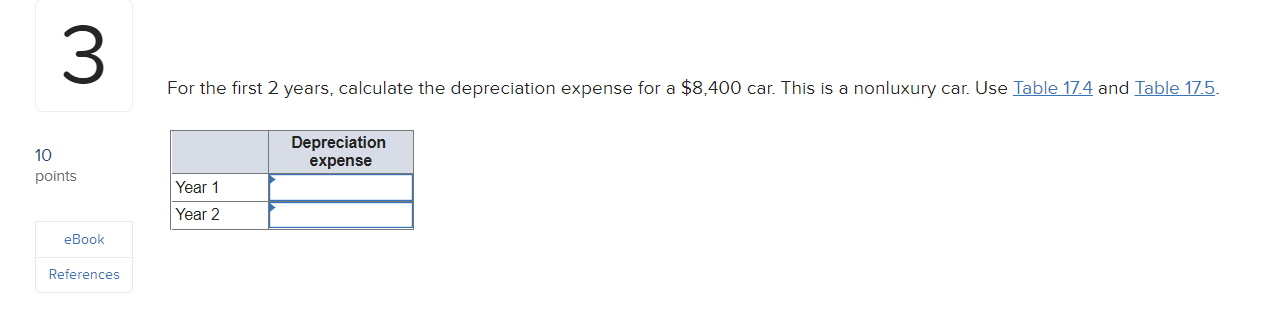

Modified Accelerated Cost Recovery System (MACRS) for assets placed in service after December 31, 1986 These classes use a 150% declining-balance method before switching to the straight-line method. These classes use a straight-line method. *Identifies when switch is made to straight line. For the first 2 years, calculate the depreciation expense for a $8,400 car. This is a nonluxury car. Use Table 17.4 and Table 17.5

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock