Question: Question 8 (30 points): Apple/Orange Manufacturing Corporation has a traditional costing system in which it applies manufacturing overhead to its products using a predetermined

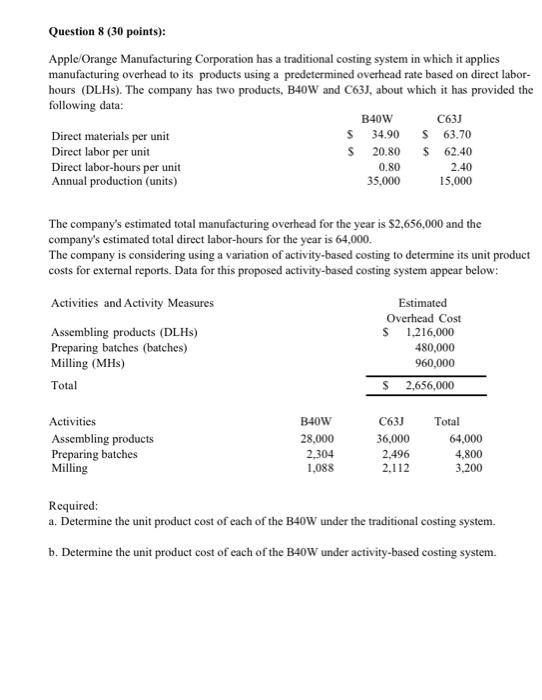

Question 8 (30 points): Apple/Orange Manufacturing Corporation has a traditional costing system in which it applies manufacturing overhead to its products using a predetermined overhead rate based on direct labor- hours (DLHS). The company has two products, B40W and C63J, about which it has provided the following data: Direct materials per unit Direct labor per unit Direct labor-hours per unit Annual production (units) Activities Assembling products Preparing batches Milling $ B40W 28,000 2,304 1,088 S B40W The company's estimated total manufacturing overhead for the year is $2,656,000 and the company's estimated total direct labor-hours for the year is 64,000. The company is considering using a variation of activity-based costing to determine its unit product costs for external reports. Data for this proposed activity-based costing system appear below: Activities and Activity Measures Assembling products (DLHs) Preparing batches (batches) Milling (MHS) Total C63J 34.90 S 63.70 20.80 $ 62.40 0.80 2.40 35,000 15,000 Estimated Overhead Cost $ 1,216,000 480,000 960,000 $ 2,656,000 C63J 36,000 2,496 2,112 Total 64,000 4,800 3,200 Required: a. Determine the unit product cost of each of the B40W under the traditional costing system. b. Determine the unit product cost of each of the B40W under activity-based costing system.

Step by Step Solution

3.44 Rating (157 Votes )

There are 3 Steps involved in it

Tradition Costing Method Particulars Sales Unit Material Per Unit ... View full answer

Get step-by-step solutions from verified subject matter experts