Question: Module 4, 5, 6, 7 & 8 Case study & Investment decisions 1. Why NPV is the basis in most of financial valuations? What is

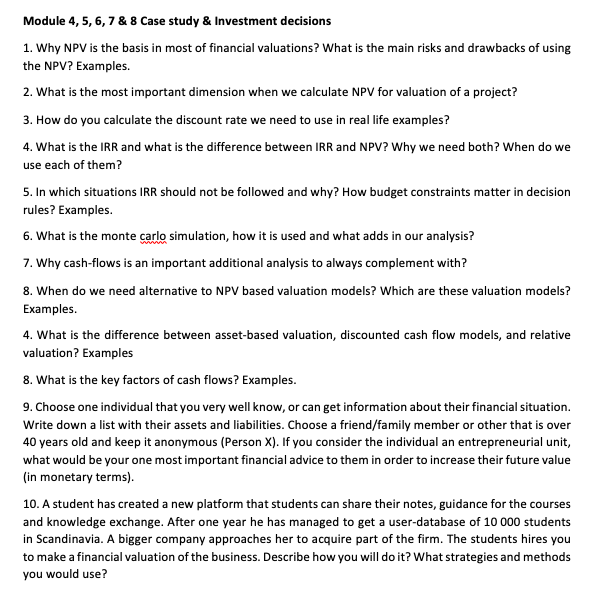

Module 4, 5, 6, 7 & 8 Case study & Investment decisions 1. Why NPV is the basis in most of financial valuations? What is the main risks and drawbacks of using the NPV? Examples. 2. What is the most important dimension when we calculate NPV for valuation of a project? 3. How do you calculate the discount rate we need to use in real life examples? 4. What is the IRR and what is the difference between IRR and NPV? Why we need both? When do we use each of them? 5. In which situations IRR should not be followed and why? How budget constraints matter in decision rules? Examples. 6. What is the monte carlo simulation, how it is used and what adds in our analysis? 7. Why cash-flows is an important additional analysis to always complement with? 8. When do we need alternative to NPV based valuation models? Which are these valuation models? Examples. 4. What is the difference between asset-based valuation, discounted cash flow models, and relative valuation? Examples 8. What is the key factors of cash flows? Examples. 9. Choose one individual that you very well know, or can get information about their financial situation. Write down a list with their assets and liabilities. Choose a friend/family member or other that is over 40 years old and keep it anonymous (Person X). If you consider the individual an entrepreneurial unit, what would be your one most important financial advice to them in order to increase their future value (in monetary terms). 10. A student has created a new platform that students can share their notes, guidance for the courses and knowledge exchange. After one year he has managed to get a user-database of 10 000 students in Scandinavia. A bigger company approaches her to acquire part of the firm. The students hires you to make a financial valuation of the business. Describe how you will do it? What strategies and methods you would use? Module 4, 5, 6, 7 & 8 Case study & Investment decisions 1. Why NPV is the basis in most of financial valuations? What is the main risks and drawbacks of using the NPV? Examples. 2. What is the most important dimension when we calculate NPV for valuation of a project? 3. How do you calculate the discount rate we need to use in real life examples? 4. What is the IRR and what is the difference between IRR and NPV? Why we need both? When do we use each of them? 5. In which situations IRR should not be followed and why? How budget constraints matter in decision rules? Examples. 6. What is the monte carlo simulation, how it is used and what adds in our analysis? 7. Why cash-flows is an important additional analysis to always complement with? 8. When do we need alternative to NPV based valuation models? Which are these valuation models? Examples. 4. What is the difference between asset-based valuation, discounted cash flow models, and relative valuation? Examples 8. What is the key factors of cash flows? Examples. 9. Choose one individual that you very well know, or can get information about their financial situation. Write down a list with their assets and liabilities. Choose a friend/family member or other that is over 40 years old and keep it anonymous (Person X). If you consider the individual an entrepreneurial unit, what would be your one most important financial advice to them in order to increase their future value (in monetary terms). 10. A student has created a new platform that students can share their notes, guidance for the courses and knowledge exchange. After one year he has managed to get a user-database of 10 000 students in Scandinavia. A bigger company approaches her to acquire part of the firm. The students hires you to make a financial valuation of the business. Describe how you will do it? What strategies and methods you would use

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts