Question: Module 5 Homework Problem 5 - 1 Chris's Beamer Biz Inc., Year 2 - 2 0 X 2 ( See previous page for beginning balances

Module Homework

Problem

Chris's Beamer Biz Inc., Year XSee previous page for beginning balances During the

second year, the company bought Beamers at $ each and sold at each. The company

has arranged terms that allow them to pay of the purchase price in cash and the rest in one year. The

company now sells the Beamers for down and the rest will be paid for by the customer next year.

The company paid rent of $ The company hired a worker who was paid $ Tax rate is the

same of taxable income Paid X taxes. The company will pay X taxes next year. The

company paid the interest to Mike on December The company paid office expenses of $ and a

dividend of $ The company also paid $ for advertising in The Post. On February the

company issued shares of common stock for $ The company owes their employees $

more in wages at the end of the year. So how did the company do

Prepare Journal Entries, Taccounts and financial statements.

Problem

Bobcat Betty's Ham Sandwich Business, Year X It was January X and Bobcat Betty had

$ and decided she wanted to become rich. She decided to operate as a corporation, so she filed the

necessary papers with the State, put the money in the bank under the company name and issued

shares of common stock to herself. On January the company paid $ to rent a cart for one year.

During the year the company bought ham sandwiches for $ each. The company paid $

cash for the sandwiches and owed $ at the end of the year. The company sold sandwiches at

$ each. In addition, the company paid salaries of $ and parking fees of $ At the end of the

year, in addition to what the company owed for sandwiches, the company owed $ in parking fees. To

secure a parking spot, the company had put down a $ security deposit at the beginning of the year.

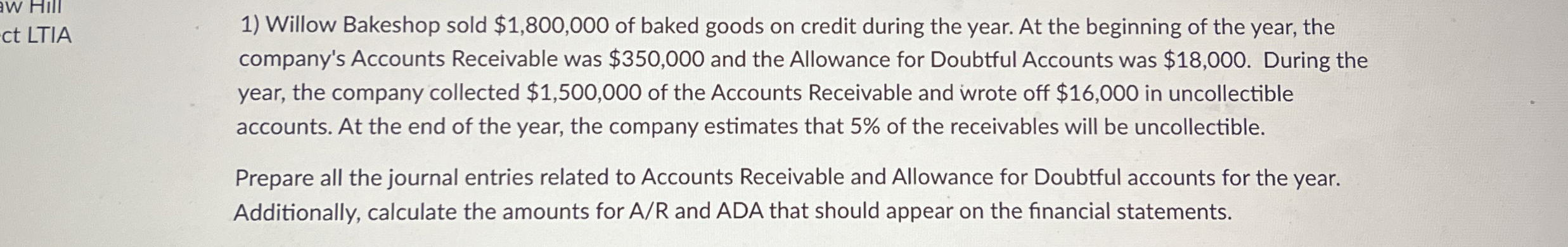

Willow Bakeshop sold $ of baked goods on credit during the year. At the beginning of the year, the

company's Accounts Receivable was $ and the Allowance for Doubtful Accounts was $ During the

year, the company collected $ of the Accounts Receivable and wrote off $ in uncollectible

accounts. At the end of the year, the company estimates that of the receivables will be uncollectible.

Prepare all the journal entries related to Accounts Receivable and Allowance for Doubtful accounts for the year.

Additionally, calculate the amounts for AR and ADA that should appear on the financial statements.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock