Question: Module 7 Chapter 18 Homework Saved 7 Required information The following information applies to the questions displayed below points Ilini Corporation reported taxable income of

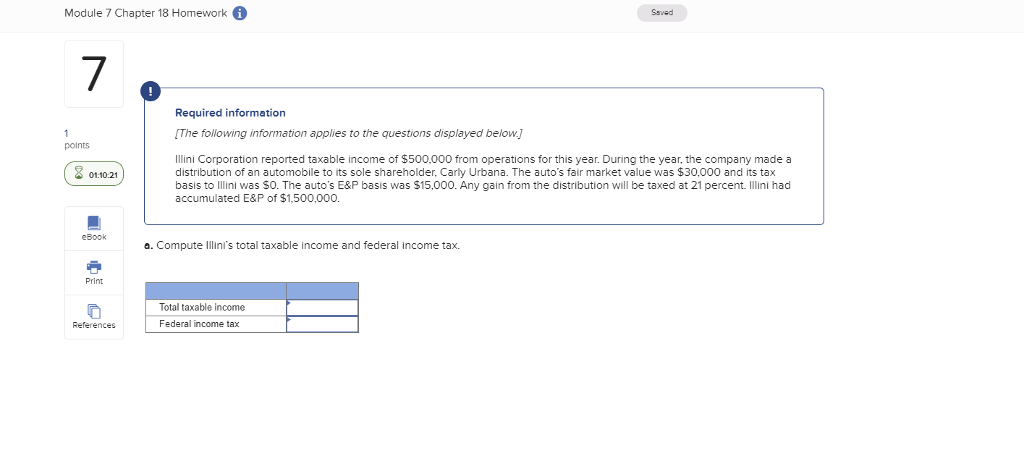

Module 7 Chapter 18 Homework Saved 7 Required information The following information applies to the questions displayed below points Ilini Corporation reported taxable income of $500,000 from operations for this year. During the year, the company made a distribution of an automobile to its sole shareholder, Carly Urbana. The auto's fair market value was $30,000 and its tax basis tolini was S0. The auto's E&P basis was $15,000. Any gain from the distribution will be taxed at 21 percent. IIlini had accumulated E&P of $1,500,000. 01.10:21 eBook a. Compute Illini's total taxable income and federal income tax. Print Total taxable income Federal income tax References

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts