Question: 4 part question ! all answers pertain to the same problem. Thanks ! Required information [The following information applies to the questions displayed below.) Volunteer

4 part question ! all answers pertain to the same problem. Thanks !

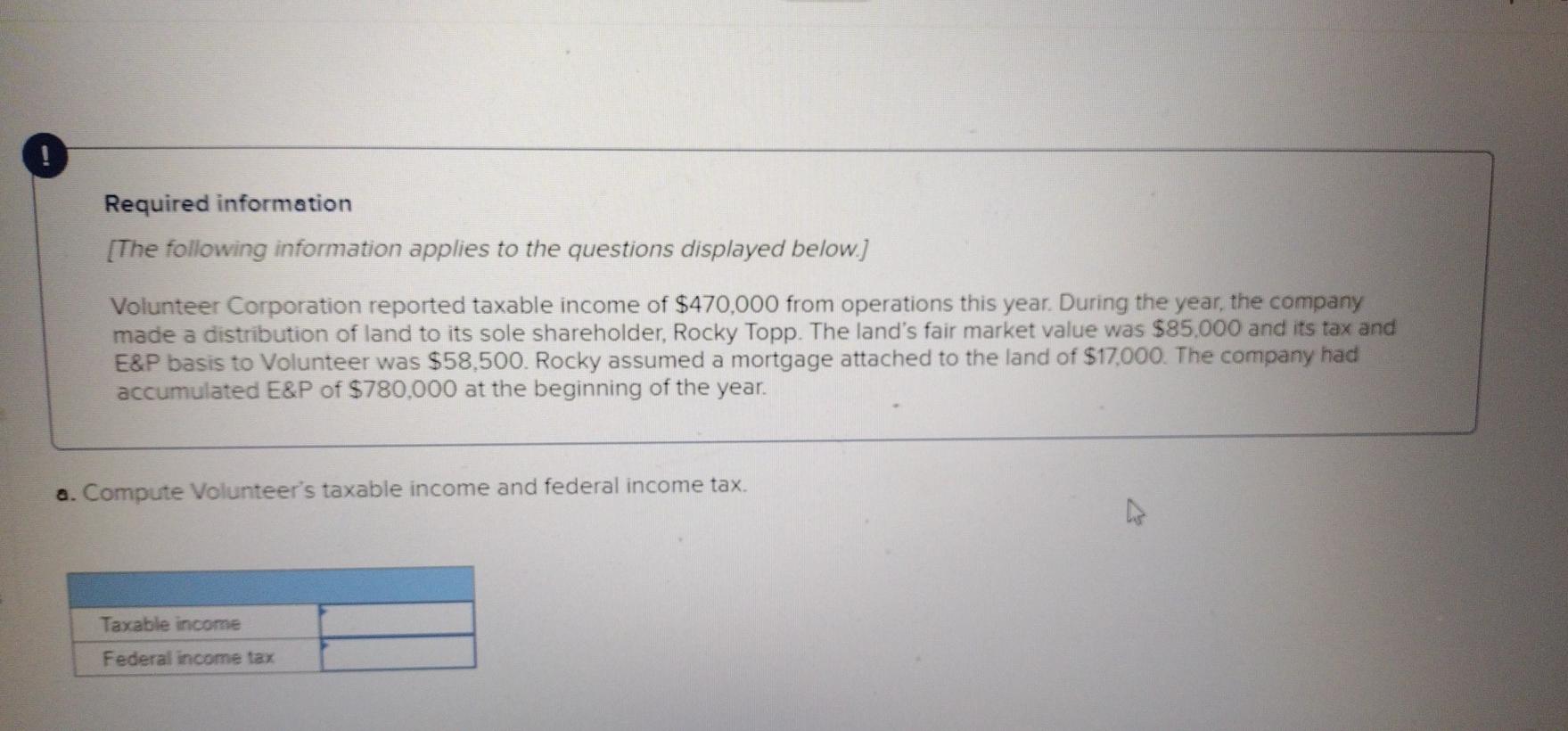

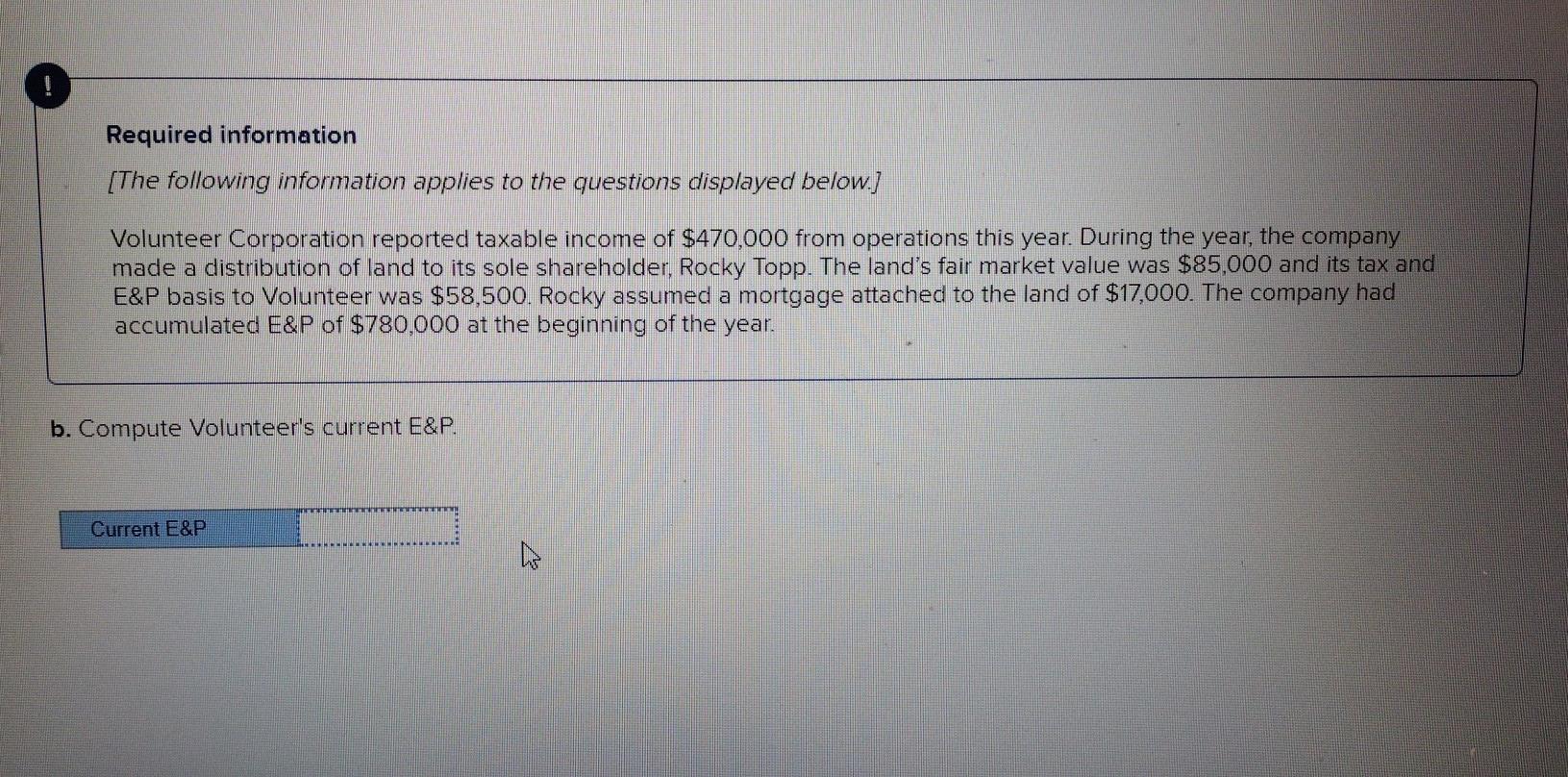

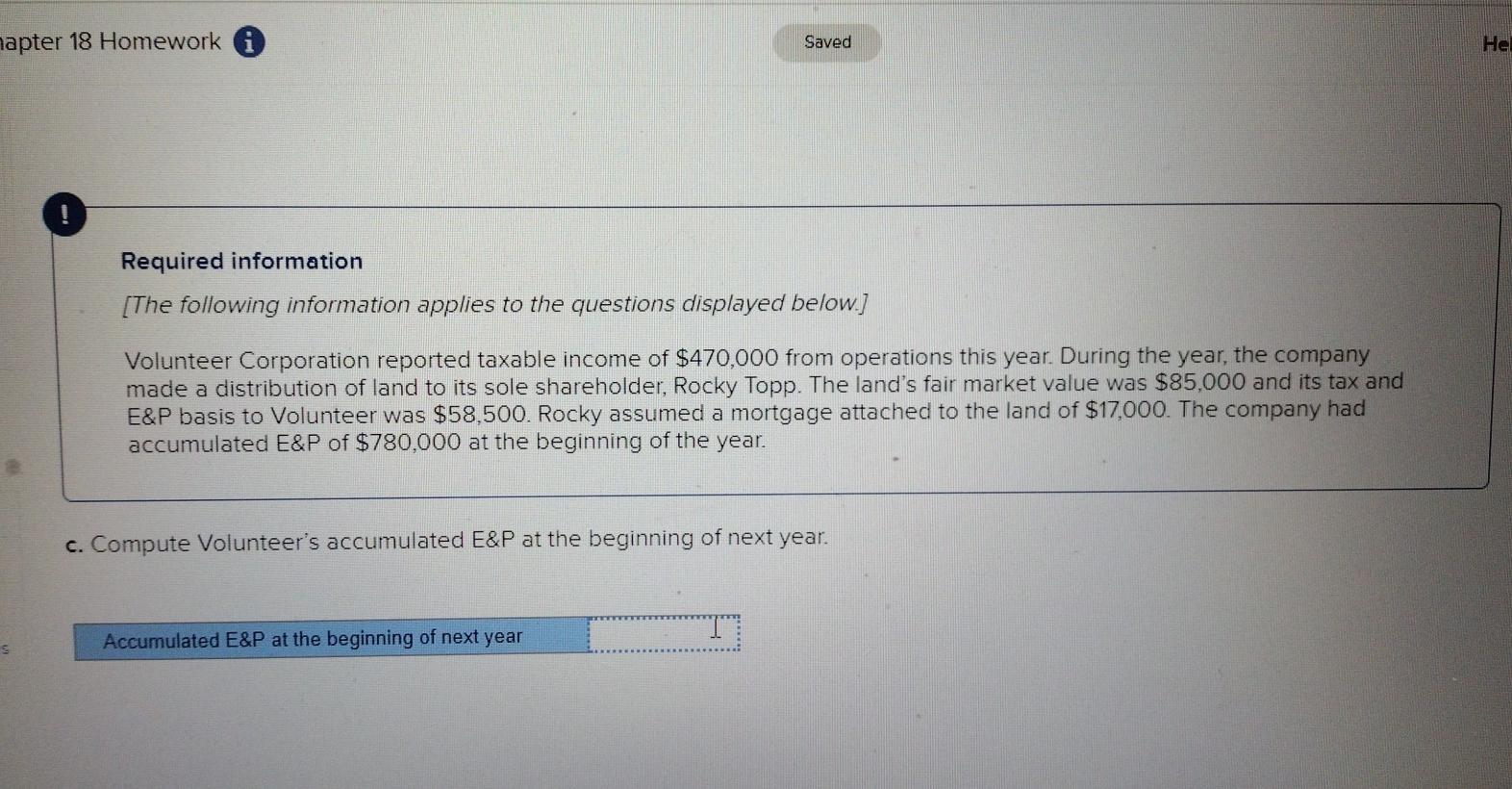

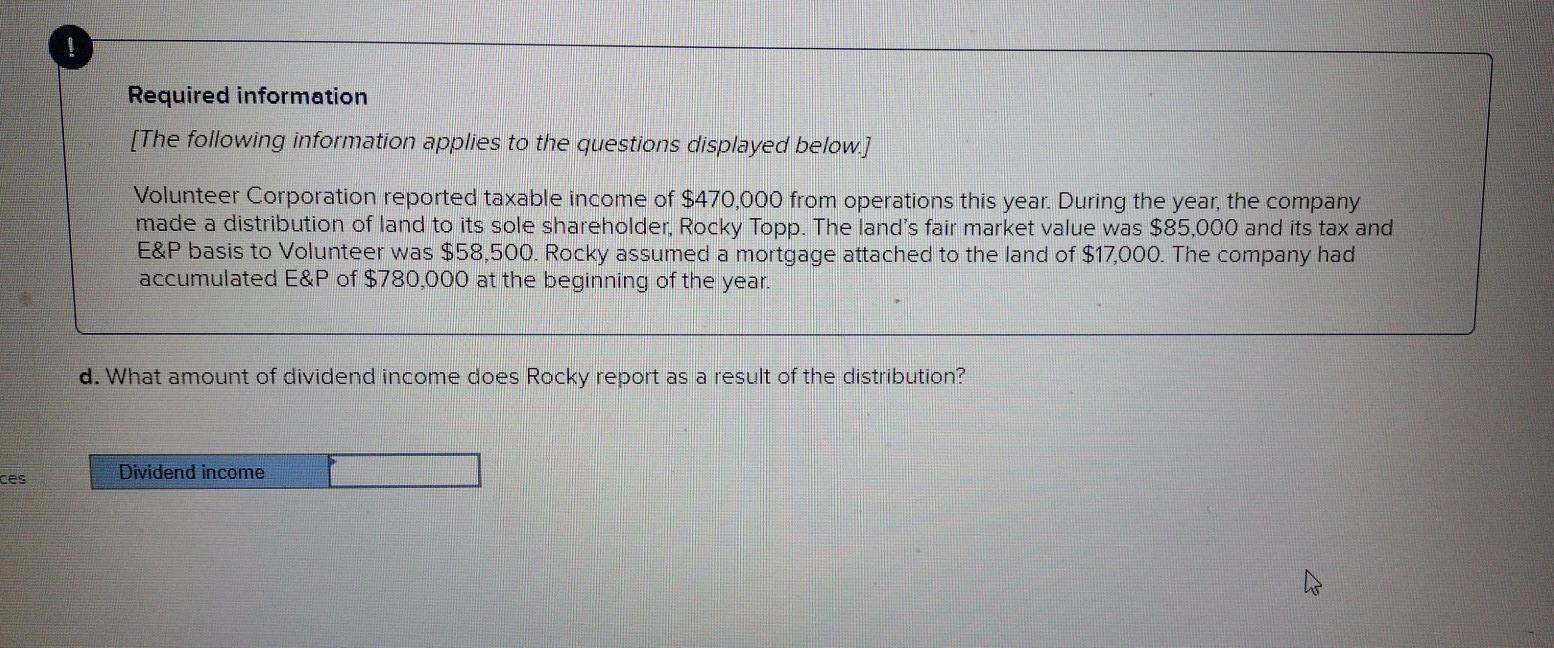

Required information [The following information applies to the questions displayed below.) Volunteer Corporation reported taxable income of $470,000 from operations this year. During the year, the company made a distribution of land to its sole shareholder, Rocky Topp. The land's fair market value was $85,000 and its tax and E&P basis to Volunteer was $58,500. Rocky assumed a mortgage attached to the land of $17,000. The company had accumulated E&P of $780,000 at the beginning of the year. a. Compute Volunteer's taxable income and federal income tax. Taxable income Federal income tax Required information [The following information applies to the questions displayed below.) Volunteer Corporation reported taxable income of $470,000 from operations this year. During the year, the company made a distribution of land to its sole shareholder, Rocky Topp. The land's fair market value was $85,000 and its tax and E&P basis to Volunteer was $58,500. Rocky assumed a mortgage attached to the land of $17,000. The company had accumulated E&P of $780,000 at the beginning of the year. b. Compute Volunteer's current E&P. Current E&P hapter 18 Homework Saved He ! Required information [The following information applies to the questions displayed below.) Volunteer Corporation reported taxable income of $470,000 from operations this year. During the year, the company made a distribution of land to its sole shareholder, Rocky Topp. The land's fair market value was $85,000 and its tax and E&P basis to Volunteer was $58,500. Rocky assumed a mortgage attached to the land of $17,000. The company had accumulated E&P of $780,000 at the beginning of the year. c. Compute Volunteer's accumulated E&P at the beginning of next year. Accumulated E&P at the beginning of next year ! Required information [The following information applies to the questions displayed below.) Volunteer Corporation reported taxable income of $470,000 from operations this year. During the year, the company made a distribution of land to its sole shareholder, Rocky Topp. The land's fair market value was $85,000 and its tax and E&P basis to Volunteer was $58,500. Rocky assumed a mortgage attached to the land of $17,000. The company had accumulated E&P of $780.000 at the beginning of the year. d. What amount of dividend income does Rocky report as a result of the distribution? ces Dividend income

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts