Question: Module Code: LCBS5009R 2. Cesim Bank has $20 million in cash and a $180 million loan portfolio. The assets are funded with demand deposits of

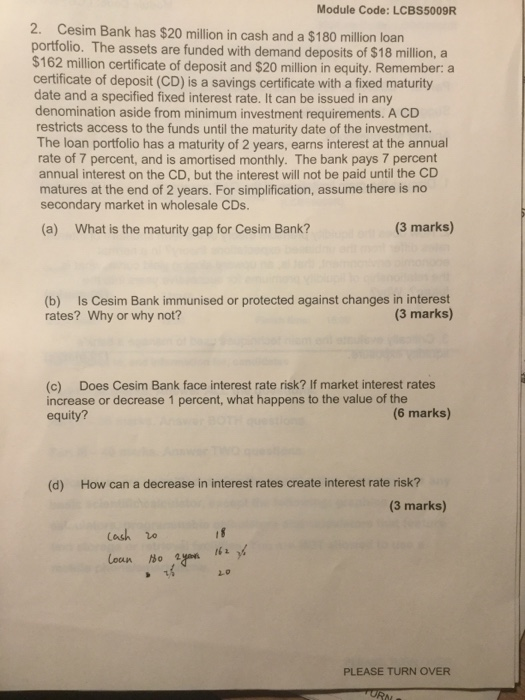

Module Code: LCBS5009R 2. Cesim Bank has $20 million in cash and a $180 million loan portfolio. The assets are funded with demand deposits of $18 million, a $162 million certificate of deposit and $20 million in equity. Remember: a certificate of deposit (CD) is a savings certificate with a fixed maturity date and a specified fixed interest rate. It can be issued in any denomination aside from minimum investment requirements. A CD restricts access to the funds until the maturity date of the investment. The loan portfolio has a maturity of 2 years, earns interest at the annual rate of 7 percent, and is amortised monthly. The bank pays 7 percent annual interest on the CD, but the interest will not be paid until the CD matures at the end of 2 years. For simplification, assume there is no secondary market in wholesale CDs. (a) What is the maturity gap for Cesim Bank? (3 marks) (b) Is Cesim Bank immunised or protected against changes in interest rates? Why or why not? (3 marks) (c) Does Cesim Bank face interest rate risk? If market interest rates increase or decrease 1 percent, what happens to the value of the equity? (6 marks) (d) How can a decrease in interest rates create interest rate risk? (3 marks) Cash re 2-0 PLEASE TURN OVER Module Code: LCBS5009R 2. Cesim Bank has $20 million in cash and a $180 million loan portfolio. The assets are funded with demand deposits of $18 million, a $162 million certificate of deposit and $20 million in equity. Remember: a certificate of deposit (CD) is a savings certificate with a fixed maturity date and a specified fixed interest rate. It can be issued in any denomination aside from minimum investment requirements. A CD restricts access to the funds until the maturity date of the investment. The loan portfolio has a maturity of 2 years, earns interest at the annual rate of 7 percent, and is amortised monthly. The bank pays 7 percent annual interest on the CD, but the interest will not be paid until the CD matures at the end of 2 years. For simplification, assume there is no secondary market in wholesale CDs. (a) What is the maturity gap for Cesim Bank? (3 marks) (b) Is Cesim Bank immunised or protected against changes in interest rates? Why or why not? (3 marks) (c) Does Cesim Bank face interest rate risk? If market interest rates increase or decrease 1 percent, what happens to the value of the equity? (6 marks) (d) How can a decrease in interest rates create interest rate risk? (3 marks) Cash re 2-0 PLEASE TURN OVER

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts