Question: page 3 QUESTION 2 (a) Briefly explain the two (2) ways a deposit-taking institution can offset the effects of asset-side 5 marks] iquidity risk such

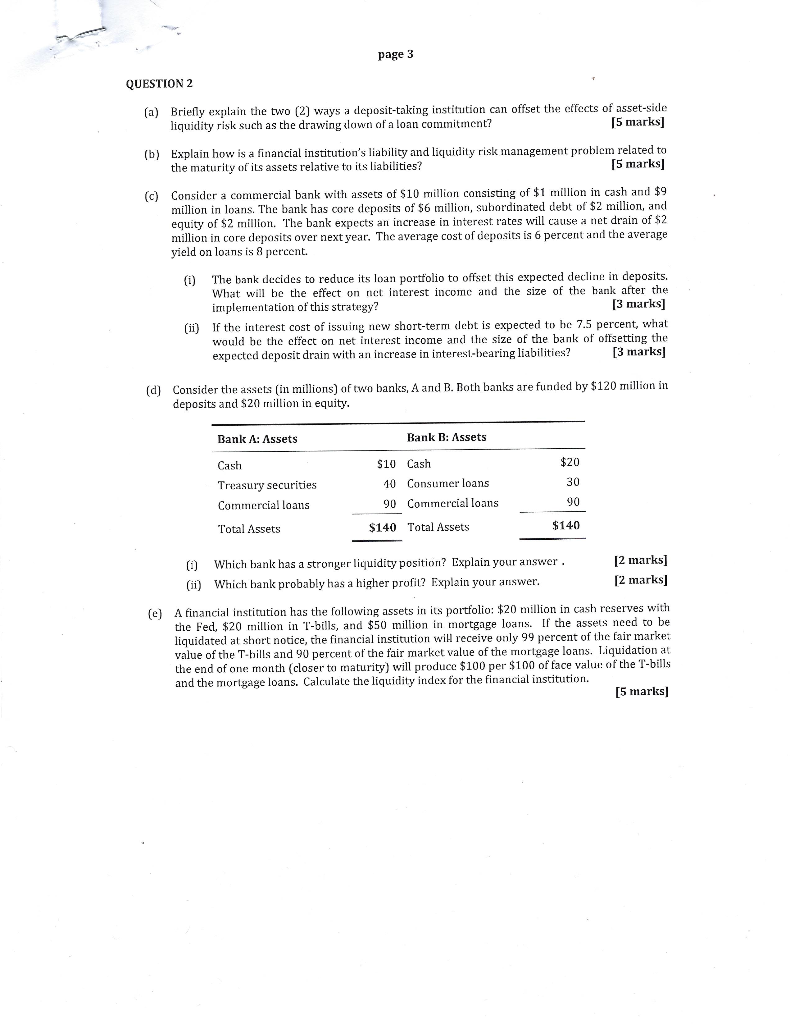

page 3 QUESTION 2 (a) Briefly explain the two (2) ways a deposit-taking institution can offset the effects of asset-side 5 marks] iquidity risk such as the drawing lown of a loan commitment? (b) Explain how is a financial institution's liability and liquidity risk management problem related to 5 marks] lblities? the maturity of its assets relative Consider a commercial bank with assets of S 10 million consisting of$1 million in cash and (c) million in loans. The bank has core deposits of S6 million, subordinated debt of S2 million, and equity of $2 mllion. The bank expects an increase in interest rates will cause a net drain of $2 million in core depasits over next year. The average cost of deposits is 6 percent and the average yield on loans is8 percent. The bank decides to reduce its loan portfolio to offset this expected decline in deposits. What be the effect on net interest income and the size of the hank after the (i) [3 marks] implementation of this strategy? If the interest cost of issuing new short-term debt is expected to he 7.5 percent, what would be the effect on net nerest income and the size of the bank of offsetting the (ii) [3 marks] expected deposit drain with an increase in interesl-bearing liabilities? (d) Consider the assets (in millions) of two banks, A and B. Both banks are funded by $120 million in deposits and S20io in equity Bank B: Assets Bank A: Assets Cash Tr asury securities Commercial loans Total Assets $20 30 90 $140 S10 Cash 10 Consumer loans 90 Commercial loans $140 Total Assets 12 marks] 2 marks () Which bank has a stronger liquidity position? Explain your answer Which bank probably has a higher profit? Explain your answer (ii) A financial institution has the following assets in its portfolio: $20 million in cash reserves with the Fed, $20 million in T-bills, and $50 million in mortgage loans. If the assets need to be liquidated at short notice, the financial institution wil receive only 99 percent of the fair marke value of the T-bills and 90 percent of the fair market value of the mortgage loans. iquidation at the end of one month (closer to maturity) will produce $100 per $100 of face valu: of he T-bills and the morlgage loans. Calculate the liquidity index for the financial institution. (e) [5 marks] page 3 QUESTION 2 (a) Briefly explain the two (2) ways a deposit-taking institution can offset the effects of asset-side 5 marks] iquidity risk such as the drawing lown of a loan commitment? (b) Explain how is a financial institution's liability and liquidity risk management problem related to 5 marks] lblities? the maturity of its assets relative Consider a commercial bank with assets of S 10 million consisting of$1 million in cash and (c) million in loans. The bank has core deposits of S6 million, subordinated debt of S2 million, and equity of $2 mllion. The bank expects an increase in interest rates will cause a net drain of $2 million in core depasits over next year. The average cost of deposits is 6 percent and the average yield on loans is8 percent. The bank decides to reduce its loan portfolio to offset this expected decline in deposits. What be the effect on net interest income and the size of the hank after the (i) [3 marks] implementation of this strategy? If the interest cost of issuing new short-term debt is expected to he 7.5 percent, what would be the effect on net nerest income and the size of the bank of offsetting the (ii) [3 marks] expected deposit drain with an increase in interesl-bearing liabilities? (d) Consider the assets (in millions) of two banks, A and B. Both banks are funded by $120 million in deposits and S20io in equity Bank B: Assets Bank A: Assets Cash Tr asury securities Commercial loans Total Assets $20 30 90 $140 S10 Cash 10 Consumer loans 90 Commercial loans $140 Total Assets 12 marks] 2 marks () Which bank has a stronger liquidity position? Explain your answer Which bank probably has a higher profit? Explain your answer (ii) A financial institution has the following assets in its portfolio: $20 million in cash reserves with the Fed, $20 million in T-bills, and $50 million in mortgage loans. If the assets need to be liquidated at short notice, the financial institution wil receive only 99 percent of the fair marke value of the T-bills and 90 percent of the fair market value of the mortgage loans. iquidation at the end of one month (closer to maturity) will produce $100 per $100 of face valu: of he T-bills and the morlgage loans. Calculate the liquidity index for the financial institution. (e) [5 marks]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts