Question: Module Five Homework Please use the financial statements below to respond to the following questions: 1 . Calculate the return on equity ( ROE )

Module Five Homework

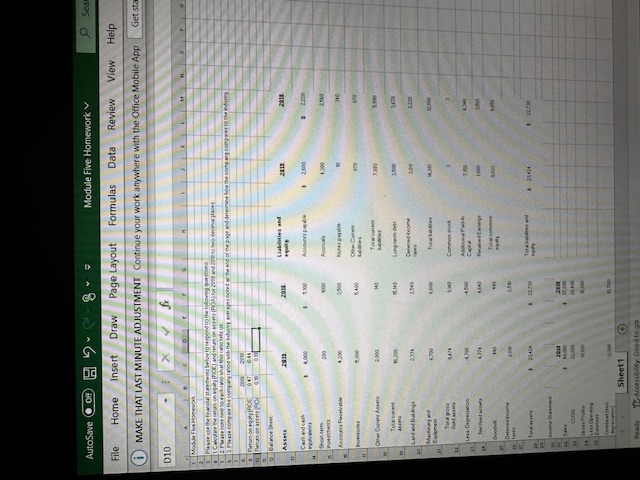

Please use the financial statements below to respond to the following questions:

Calculate the return on equity ROE and return on assets ROA for and to two decimal places.

Please note next to each ratio what this ratio tells us

Please compare the company ratios with the industry averages noted at the end of the page and determine how the company compares to the industry.

Return on equity ROE

Return on assets ROA

Balance Sheet:

Assets Liabilities and equity

Cash and cash equivalents $ $ Accounts payable $ $

Shortterm investments Accruals

Accounts Receivable Notes payable

Inventories Other Current liabilities

Other Current Assets Total current liabilities

Total current assets Longterm debt

Land and Buildings Deferred income taxes

Machinery and Equipment Total liabilities

Total gross fixed assets Common stock

Less: Depreciation Additional PaidIn Capital

Net fixed assets Retained Earnings

Goodwill Total common equity

Deferred income taxes

Total assets $ $ Total liabilities and equity $ $

Income Statement:

Sales $ $

COGS

Gross Profits

Less Operating Expenses

Overhead excl depreciation

EBITDA

Depreciation

Operating Profit EBIT

Interest expense

Net Profit before Taxes EBT

Taxes

Net Income $ $

Number of shares of common stock outstanding in and

Industry Averages:

Return on equity ROE

The company paid out a portion of the net income as dividends in and

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock