Question: Module%209.0%3A%20Lesson%209?preview : 9 1 932830 Question 3 (40 points): Suppose you have to decide between selling an old machine or keeping it with a major

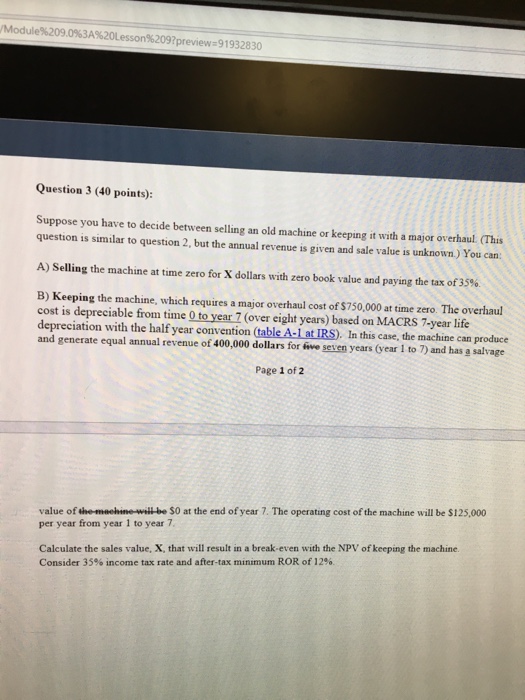

Module%209.0%3A%20Lesson%209?preview : 9 1 932830 Question 3 (40 points): Suppose you have to decide between selling an old machine or keeping it with a major overhaul This question is similar to question 2, but the annual revenue is given and sale value is unknown.) You can A) Selling the machine at time zero for X dollars with zero book value and paying the tax of 35% B) Keeping the machine, which requires a major overhaul cost of $750,000 at time zero. The overhaul cost is depreciable from time 0 to year 7 (over eight years) based on MACRS 7-year life depreciation with the half year convention (table A-1 at IRS). In this case, the machine can produce and generate equal annual revenue of 400,000 dollars for ive seven years (vear 1 to 7) and has g salvage Page 1 of 2 value of the machine will be $0 at the end of year 7. The operating cost of the machine will be $125,000 per year from year 1 to year 7 Calculate the sales value, X, that will result in a break-even with the NPV of keeping the machine Consider 35% income tax rate and after-tax minimum ROR of 12%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts