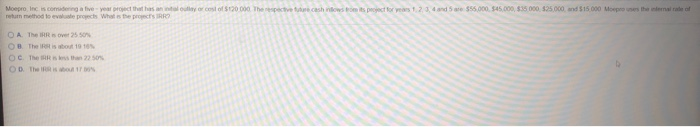

Question: Moepro, Inc. is considering a five - year project that has an initial outlay or cost of $120,000. The respective future cashinflows from its projects

Moepro Inc. is.coming a five-year pred that has to or cost of 120.000. The respective cash rows tomis project for years 1.2.3.4 and 5 $55.000.545.000 $35.000,25.000 and $15.00 Morps the leader of return method to evaluate projects What is the project IRRO O A The 2550 OB Thesis about 1910 OC The Ritha 22 50% OD. This woul

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts