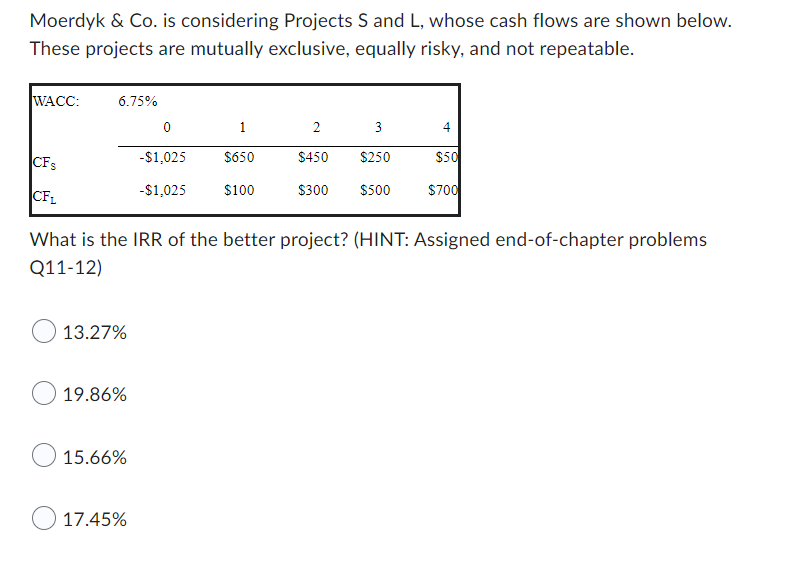

Question: Moerdyk & Co. is considering Projects S and L, whose cash flows are shown below. These projects are mutually exclusive, equally risky, and not repeatable.

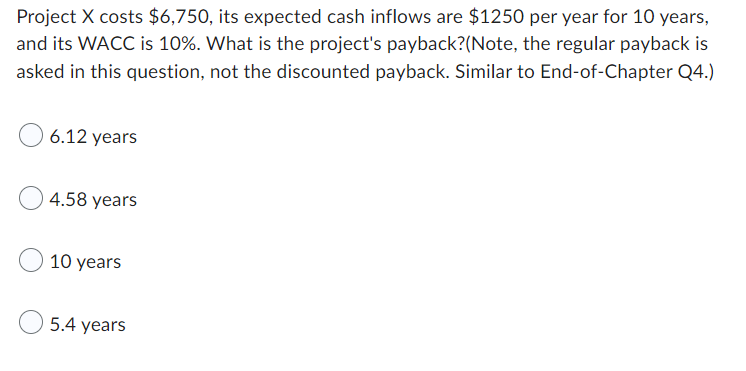

Moerdyk & Co. is considering Projects S and L, whose cash flows are shown below. These projects are mutually exclusive, equally risky, and not repeatable. WACC: CFS CFL 6.75% 13.27% 19.86% 15.66% 0 -$1,025 $650 -$1,025 $100 What is the IRR of the better project? (HINT: Assigned end-of-chapter problems Q11-12) 17.45% 2 $450 3 $250 $300 $500 4 $50 $700 Project X costs $6,750, its expected cash inflows are $1250 per year for 10 years, and its WACC is 10%. What is the project's payback? (Note, the regular payback is asked in this question, not the discounted payback. Similar to End-of-Chapter Q4.) 6.12 years 4.58 years 10 years 5.4 years

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts