Question: Monali and her spouse, Nitish, met while working at Hydro - Quebec, Monali earns a gross annual salary of $ 1 2 0 , 0

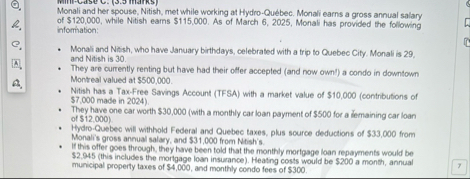

Monali and her spouse, Nitish, met while working at HydroQuebec, Monali earns a gross annual salary of $ while Nitish earns $ As of March Monali has provided the following information:

Monali and Nitish, who have January birthdays, celebrated with a trip to Quebec City. Monali is and Nitish is

They are currently renting but have had their offer accepled and now ownl' a condo in downtown Montreal valued at $

Nitish has a TaxFree Savings Account TFSA with a market value of $contributions of $ made in

They have one car worth $with a monthly car loan payment of $ for a lemaining car loan of $

HydroQuebec will withhold Federal and Quebec taxes, plus source deductions of $ from Monalis gross annual salary, and $ from Ntish's.

If this offer goes through, they have been told that the monthly morigage loan repayments would be $this includes the mortgage loan insurance Heating costs would be $ a month, annual municipal property taxes of $ and monthly condo fees of $

Calculate their disposable income

monali has never contirbuted to her tax free saving account how much can she contirbute as of march Consider carryforward contirbution room.

how much can nitish contirbutes to his tax free sahing accounts as of mardh consider carryforward contirbution room.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock