Question: Money demand volatility Example answer: Money demand is 'liquidity preference' and depends negatively on interest rates and positively on nominal income. Money demand volatility arises

Money demand volatility

Example answer: Money demand is 'liquidity preference' and depends negatively on interest rates and positively on nominal income. Money demand volatility arises if the perceived risk (i.e. of default) of illiquid assets changes. In 'good times' ('bad times') this risk is low (high) and money demand correspondingly low (high). According to the Poole (1970) model money demand volatility induces macroeconomic volatility under money-supply setting. If it is high then interest-rate setting is preferred to money supply setting.

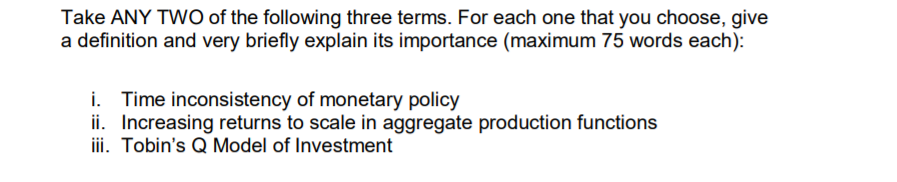

Take ANY TWO of the following three terms. For each one that you choose, give a definition and very briefly explain its importance (maximum 75 words each): i. Time inconsistency of monetary policy ii. Increasing returns to scale in aggregate production functions iii. Tobin's Q Model of Investment

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts