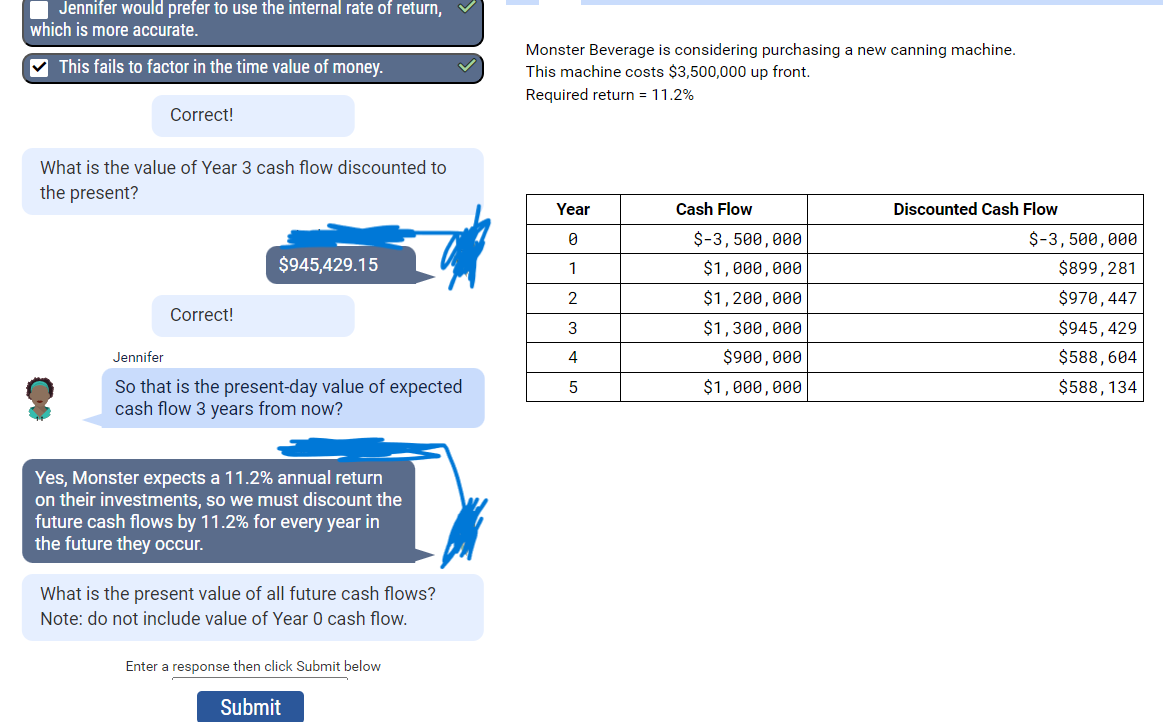

Question: Monster Beverage is considering purchasing a new canning machine. This machine costs $3,500,000 up front. Required return =11.2% What is the value of Year 3

Monster Beverage is considering purchasing a new canning machine. This machine costs $3,500,000 up front. Required return =11.2% What is the value of Year 3 cash flow discounted to the present? Jennifer So that is the present-day value of expected cash flow 3 years from now? Yes, Monster expects a 11.2% annual return on their investments, so we must discount the future cash flows by 11.2% for every year in the future they occur. What is the present value of all future cash flows? Note: do not include value of Year 0 cash flow. Enter a response then click Submit below

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts