Question: More choice available D) 36.71% E) 25.81% D) 8,385 E) 7,010 The tax rates for a particular year are shown below 3 Tax Rate 150

More choice available

More choice available

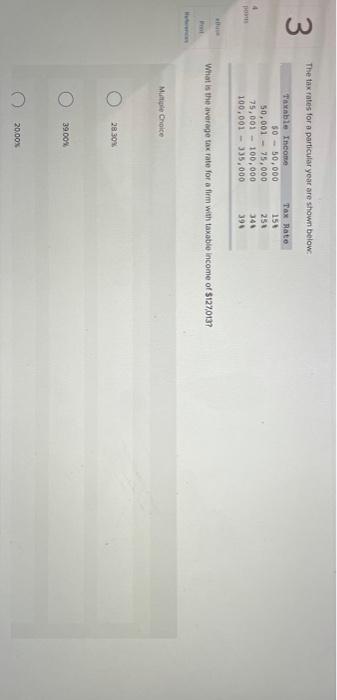

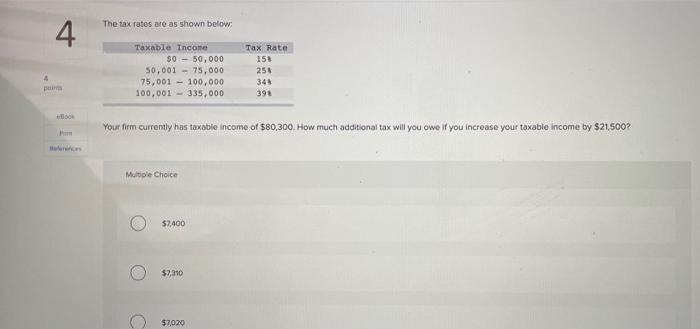

The tax rates for a particular year are shown below 3 Tax Rate 150 Taxable income 50 - 50.000 50,001 - 75.000 75,001 - 100,000 100,001 - 335,000 250 4 340 390 What is the average tax rate for a firm with taxable income of $127,013? Me Choice 28 30 O 39.00 C 20.00 The tax rates are as shown below: 4 Tax Rate 156 Taxable income $0 - 50,000 50,001 - 75,000 75,001 - 100,000 100,001 - 335,000 250 344 pe 398 Your firm currently has taxable income of $80,300. How much additional tax will you owe if you increase your taxable income by $21.500? Multiple Choice 57,400 $7,310 $7,020

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts