Question: Most installment loan contracts that use the add-on method include a prepayment penalty. A prepayment penalty is a special charge assessed to the borrower for

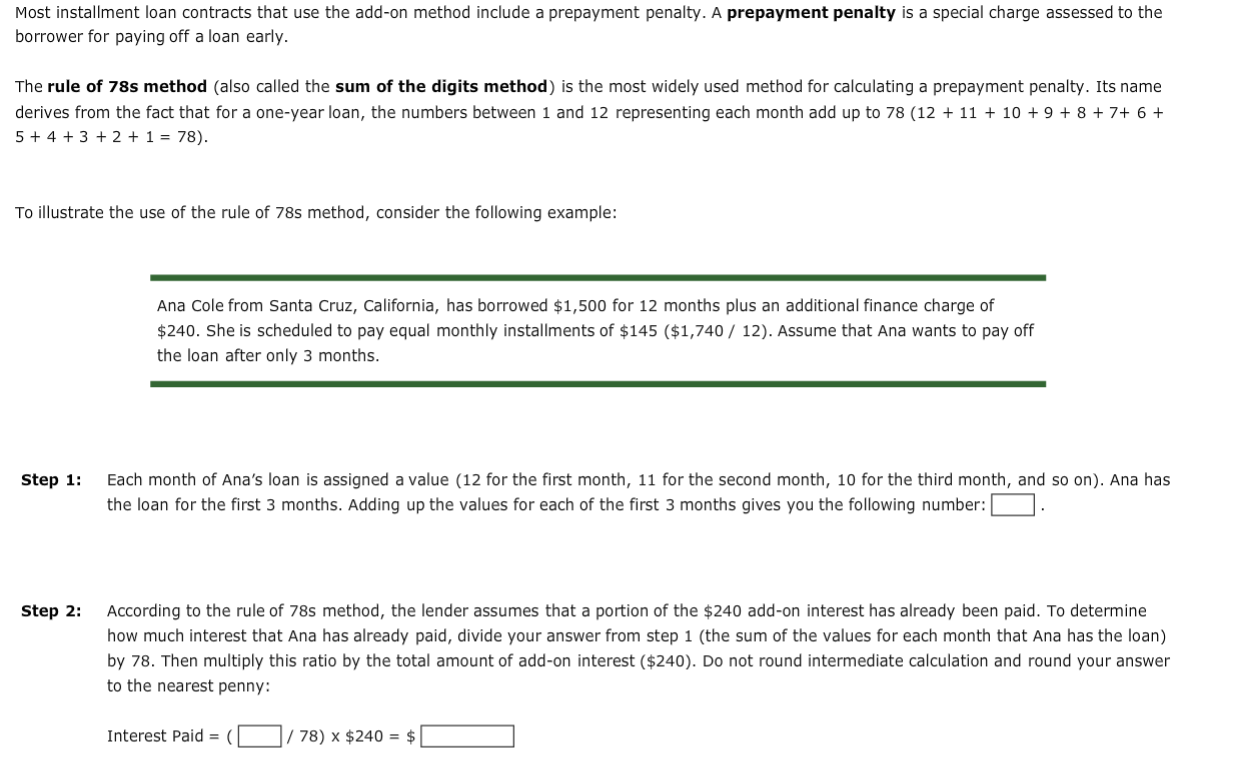

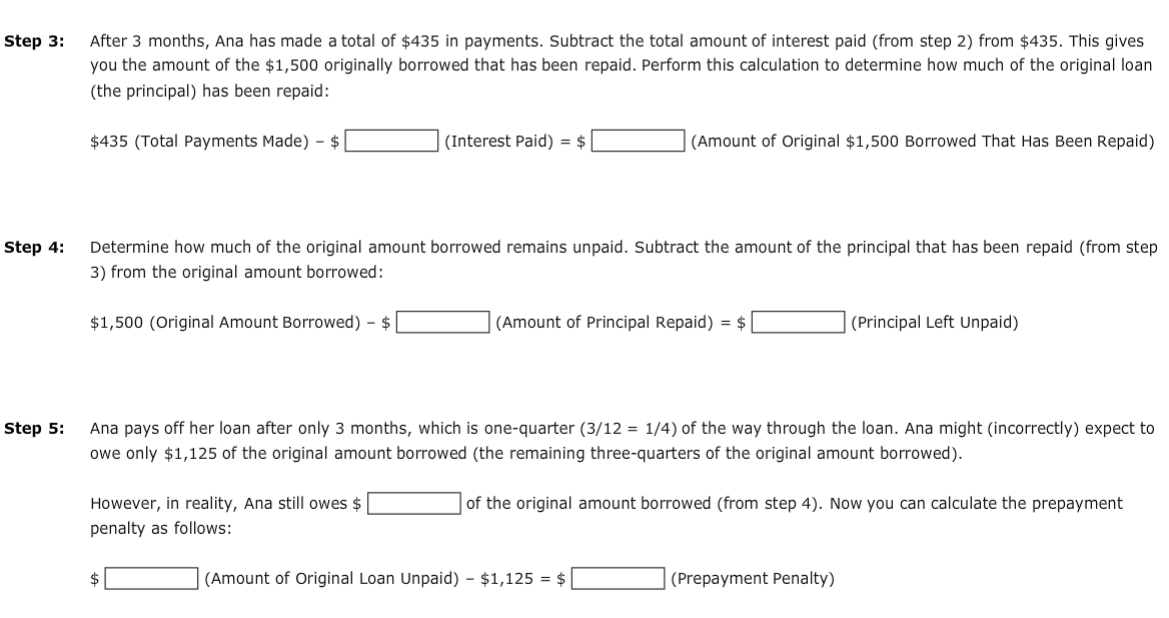

Most installment loan contracts that use the add-on method include a prepayment penalty. A prepayment penalty is a special charge assessed to the borrower for paying off a loan early. The rule of 78s method (also called the sum of the digits method) is the most widely used method for calculating a prepayment penalty. Its name derives from the fact that for a one-year loan, the numbers between 1 and 12 representing each month add up to 78 (12 + 11 + 10 + 9 + 8 + 7+ 6 + 5 + 4 + 3 + 2 + 1 = 78). To illustrate the use of the rule of 785 method, consider the following example: Ana Cole from Santa Cruz, California, has borrowed $1,500 for 12 months plus an additional finance charge of $240. She is scheduled to pay equal monthly installments of $145 ($1,740 / 12). Assume that Ana wants to pay off the loan after only 3 months. Step 1: Each month of Ana's loan is assigned a value (12 for the first month, 11 for the second month, 10 for the third month, and so on). Ana has the loan for the first 3 months. Adding up the values for each of the first 3 months gives you the following number: Step 2: According to the rule of 785 method, the lender assumes that a portion of the $240 add-on interest has already been paid. To determine how much interest that Ana has already paid, divide your answer from step 1 (the sum of the values for each month that Ana has the loan) by 78. Then multiply this ratio by the total amount of add-on interest ($240). Do not round intermediate calculation and round your answer to the nearest penny: Interest Paid = (78) x $240 = $ Step 3: After 3 months, Ana has made a total of $435 in payments. Subtract the total amount of interest paid (from step 2) from $435. This gives you the amount of the $1,500 originally borrowed that has been repaid. Perform this calculation to determine how much of the original loan (the principal) has been repaid: $435 (Total Payments Made) - $ (Interest Paid) = $ (Amount of Original $1,500 Borrowed That Has Been Repaid) Step 4: Determine how much of the original amount borrowed remains unpaid. Subtract the amount of the principal that has been repaid (from step 3) from the original amount borrowed: $1,500 (Original Amount Borrowed) - $ (Amount of Principal Repaid) = $ (Principal Left Unpaid) Step 5: Ana pays off her loan after only 3 months, which is one-quarter (3/12 = 1/4) of the way through the loan. Ana might (incorrectly) expect to owe only $1,125 of the original amount borrowed (the remaining three-quarters of the original amount borrowed). of the original amount borrowed (from step 4). Now you can calculate the prepayment However, in reality, Ana still owes $ penalty as follows: (Amount of Original Loan Unpaid) - $1,125 = $ (Prepayment Penalty)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts