Question: Most installment loan contracts that use the add-on method include a prepayment penalty. A prepayment penalty is a special charge assessed to the borrower for

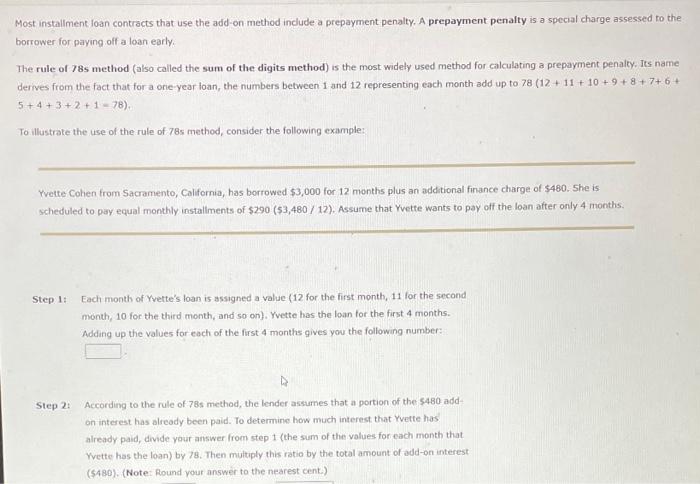

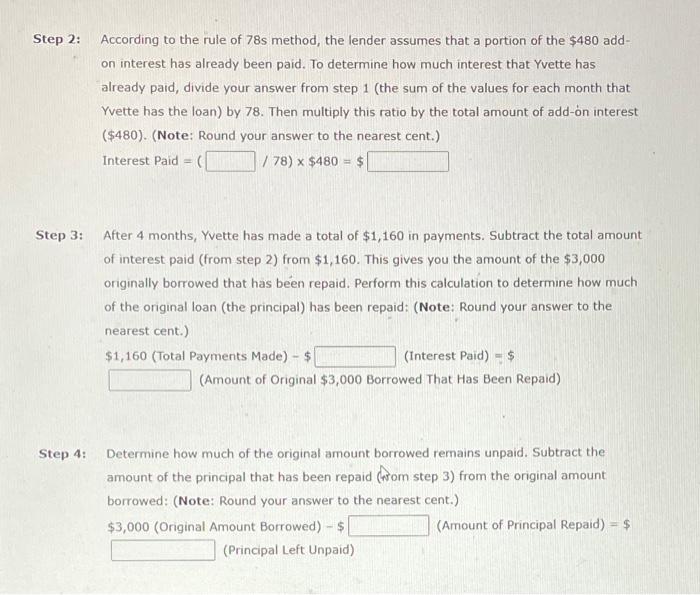

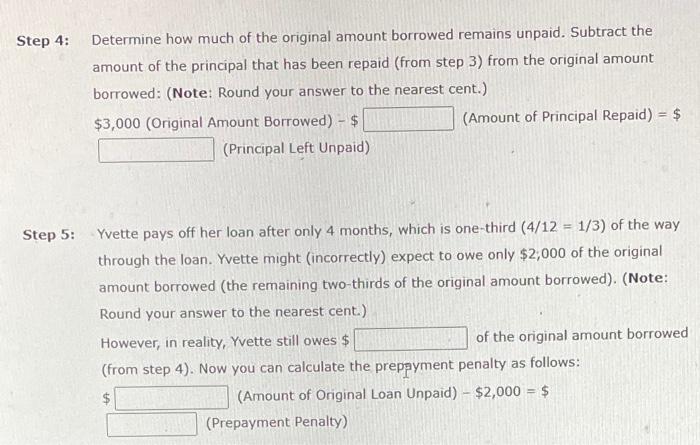

Most installment loan contracts that use the add-on method include a prepayment penalty. A prepayment penalty is a special charge assessed to the borrower for paying off a loan early. The rule of 78 s method (also called the sum of the digits method) is the most widely used method for calculating a prepayment penalty. Its name derives from the fact that for a orie-year loan, the numbers between 1 and 12 representing each month add up to 78(12+11+10+9+8+7+6+ 5+4+3+2+1=78) To illustrate the use of the rule of 78 s method, consider the following example: Yvette Cohen from Sacramento, California, has borrowed $3,000 for 12 months plus an additional firance charge of $480. 5 he is scheduled to pay equal monthly installments of $290($3,480/12). Assume that Yvette wants to pay off the loan after only 4 months. Step 1: Each month of Yvette's loan is assigned a value (12 for the first month, 11 for the second month, 10 for the third month, and so on). Yvette has the loan for the first 4 months. Adding up the values for each of the first 4 months gives you the following number: Step 2: According to the rule of 78 s method, the lender assumes that a portion of the 5480 add on interest has already been paid. To determine how much interest that Yvette has already paid, divide yaur answer from step 1 (the sum of the values for each month that Yrette has the loan) by 78 . Then muitiply this ratio by the total amount of add-on interest ( 5480). (Note: Round your answer to the nearest cent.) ep 2: According to the rule of 78 s method, the lender assumes that a portion of the $480 addon interest has already been paid. To determine how much interest that Yvette has already paid, divide your answer from step 1 (the sum of the values for each month that Yvette has the loan) by 78 . Then multiply this ratio by the total amount of add-on interest ( $480). (Note: Round your answer to the nearest cent.) InterestPaid=(/78)$480=$ After 4 months, Yvette has made a total of $1,160 in payments. Subtract the total amount of interest paid (from step 2) from $1,160. This gives you the amount of the $3,000 originally borrowed that has been repaid. Perform this calculation to determine how much of the original loan (the principal) has been repaid: (Note: Round your answer to the nearest cent.) $1,160 (Total Payments Made) - $ (Interest Paid) =$ (Amount of Original $3,000 Borrowed That Has Been Repaid) Determine how much of the original amount borrowed remains unpaid. Subtract the amount of the principal that has been repaid (Nom step 3) from the original amount borrowed: (Note: Round your answer to the nearest cent.) $3,000 (Original Amount Borrowed) - $ (Amount of Principal Repaid) =$ (Principal Left Unpaid) Determine how much of the original amount borrowed remains unpaid. Subtract the amount of the principal that has been repaid (from step 3) from the original amount borrowed: (Note: Round your answer to the nearest cent.) $3,000 (Original Amount Borrowed) - $ (Amount of Principal Repaid) =$ (Principal Left Unpaid) Yvette pays off her loan after only 4 months, which is one-third (4/12=1/3) of the way through the loan. Yvette might (incorrectly) expect to owe only $2;000 of the original amount borrowed (the remaining two-thirds of the original amount borrowed). (Note: Round your answer to the nearest cent.) However, in reality, Yvette still owes $ of the original amount borrowed (from step 4). Now you can calculate the preppyment penalty as follows: (Amount of Original Loan Unpaid) $2,000=$ (Prepayment Penalty)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts