Question: Mountain Sporting Goods, Inc. An existing sporting goods manufacturer is creating a separate division to manufacture basketballs under a private label for a major

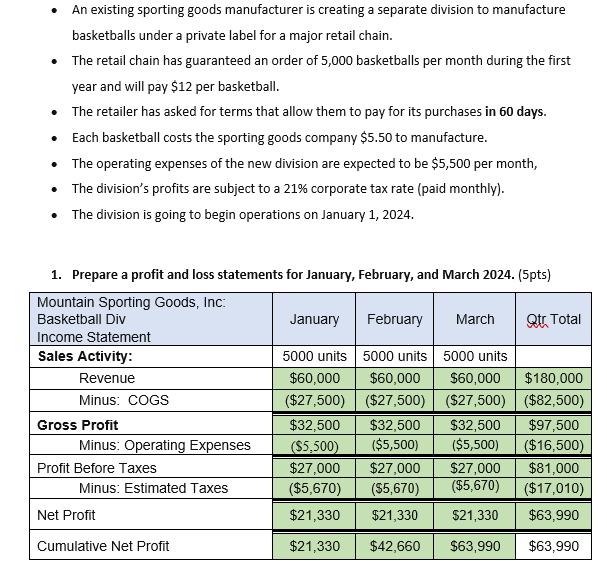

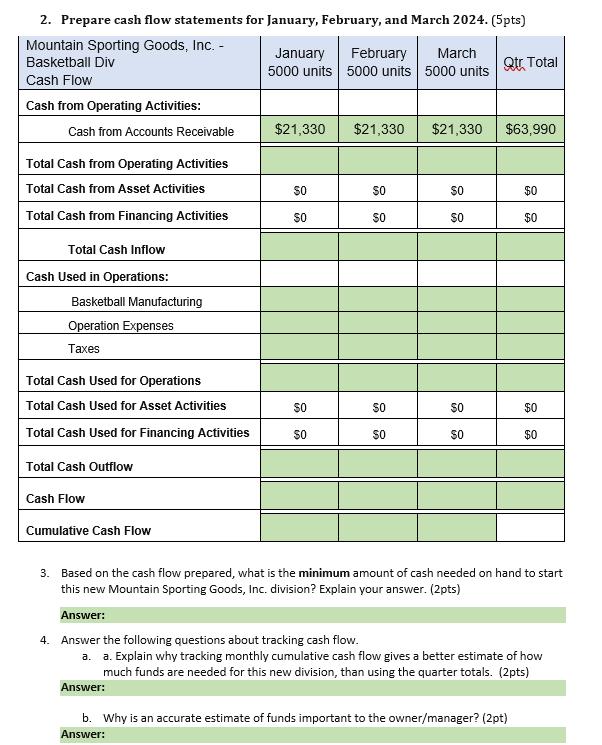

Mountain Sporting Goods, Inc. An existing sporting goods manufacturer is creating a separate division to manufacture basketballs under a private label for a major retail chain. The retail chain has guaranteed an order of 5,000 basketballs per month during the first year and will pay $12 per basketball. The retailer has asked for terms that allow them to pay for its purchases in 60 days. Each basketball costs the sporting goods company $5.50 to manufacture. The operating expenses of the new division are expected to be $5,500 per month, The division's profits are subject to a 21% corporate tax rate (paid monthly). The division is going to begin operations on January 1, 2024. . 1. Prepare a profit and loss statements for January, February, and March 2024. (5pts) Mountain Sporting Goods, Inc: Basketball Div Income Statement Sales Activity: Revenue Minus: COGS Gross Profit Minus: Operating Expenses Profit Before Taxes Minus: Estimated Taxes Net Profit Cumulative Net Profit January February 5000 units $60,000 ($27,500) 5000 units $60,000 ($27,500) $32,500 $32,500 ($5,500) ($5,500) March 5000 units $60,000 ($27,500) $32,500 ($5,500) $27,000 $27,000 $27,000 ($5,670) ($5,670) ($5,670) $21,330 $21,330 $21,330 $21,330 $42,660 $63,990 Qtr Total $180,000 ($82,500) $97,500 ($16,500) $81,000 ($17,010) $63,990 $63,990 2. Prepare cash flow statements for January, February, and March 2024. (5pts) Mountain Sporting Goods, Inc. - Basketball Div Cash Flow Cash from Operating Activities: Cash from Accounts Receivable Total Cash from Operating Activities Total Cash from Asset Activities Total Cash from Financing Activities Total Cash Inflow Cash Used in Operations: Basketball Manufacturing Operation Expenses Taxes Total Cash Used for Operations Total Cash Used for Asset Activities Total Cash Used for Financing Activities Total Cash Outflow Cash Flow Cumulative Cash Flow January February March 5000 units 5000 units 5000 units $21,330 $21,330 SO SO SO so SO $0 SO SO $21,330 $0 SO 88 Qtr Total $63,990 $0 $0 $0 $0 3. Based on the cash flow prepared, what is the minimum amount of cash needed on hand to start this new Mountain Sporting Goods, Inc. division? Explain your answer. (2pts) Answer: b. Why is an accurate estimate of funds important to the owner/manager? (2pt) Answer: Answer: 4. Answer the following questions about tracking cash flow. a. a. Explain why tracking monthly cumulative cash flow gives a better estimate of how much funds are needed for this new division, than using the quarter totals. (2pts)

Step by Step Solution

3.42 Rating (155 Votes )

There are 3 Steps involved in it

1 2 3 The minimum amount of cash needed on hand to start is nil Because the retail chain has guaranteed an order of 5000 basketballs per month at 12 e... View full answer

Get step-by-step solutions from verified subject matter experts