Question: Moving to another question will save this response 12445 Question 6 5.5 points Sam Are Hamad Company signs a lease agreement on January 1,

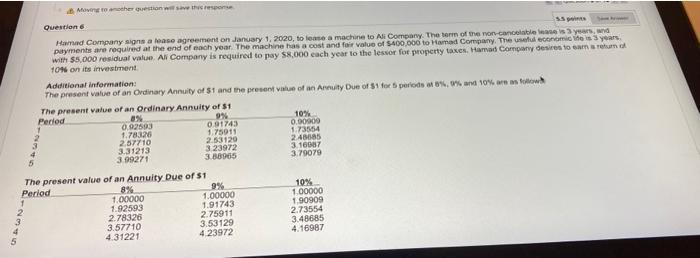

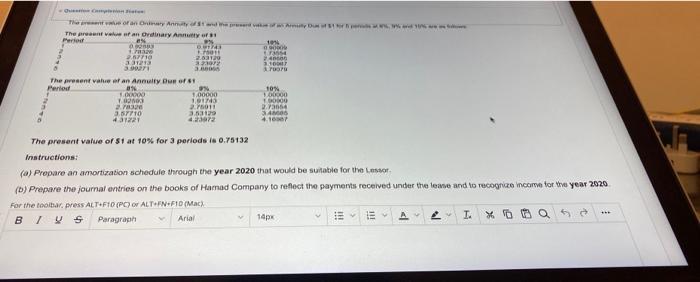

Moving to another question will save this response 12445 Question 6 5.5 points Sam Are Hamad Company signs a lease agreement on January 1, 2020, to lease a machine to Ali Company. The term of the non-cancelable lease is 3 years, and payments are required at the end of each year. The machine has a cost and fair value of $400,000 to Hamad Company. The useful economic life is 3 years. with $5,000 residual value. Ali Company is required to pay $8,000 each year to the lessor for property taxes. Hamad Company desires to earn a return of 10% on its investment Additional information: The present value of an Ordinary Annuity of $1 and the present value of an Annuity Due of $1 for 5 periods at 8%, 9% and 10% are as follow The present value of an Ordinary Annuity of $1 Period 8% 0.92593 1.78326 2.57710 3.31213 3.99271 5 The present value of an Annuity Due of $1 Period 8% 1.00000 9% 0.91743 1.75911 2.53129 1.92593 2.78326 3.57710 4.31221 3.23972 3.88965 9% 1.00000 1.91743 2.75911 3.53129 4.23972 10% 0.00000 1.73554 2.48685 3.16087 3.79079 10% 1.00000 1.90909 2.73554 3.48685 4.16987 Question Comp The value of an Ondary Annuity of and the preserve of Army Dus of 1 for pets at 176, 19% de 1976 The present value of an Ordinary Annuity of 1 Period 0923 11213 1.90271 2.03129 123972 3.00005 The present value of an Annulty Due of $1 Period 8% 100000 1.02503 9% 1.00000 1,91745 2.75011 2.78326 3.53129 3.57710 4.31221 4.23972 The present value of $1 at 10% for 3 periods is 0.75132 10% 090000 173554 240000 310007 370070 10% 100000 1.00000 2.73664 3.48006 4.10007 Instructions: (a) Prepare an amortization schedule through the year 2020 that would be suitable for the Lessor (b) Prepare the journal entries on the books of Hamad Company to reflect the payments received under the lease and to recognize income for the year 2020 For the toolbar, press ALT+F10 (PC) or ALT+FN-F10 (Mac) B Paragraph Arial 14px EEE www Colones 2 I. Xa ***

Step by Step Solution

3.44 Rating (157 Votes )

There are 3 Steps involved in it

Answer Calculation of annual lease payment Fair value of the lease 400000 Less PV of residua... View full answer

Get step-by-step solutions from verified subject matter experts