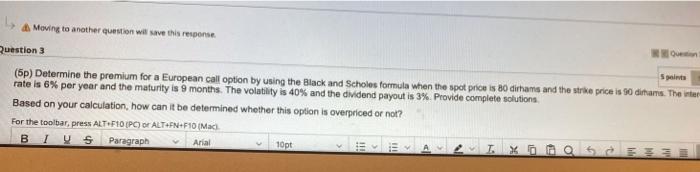

Question: Moving to another question will save this response KO Question 3 Spain (5p) Determine the premium for a European call option by using the Black

Moving to another question will save this response KO Question 3 Spain (5p) Determine the premium for a European call option by using the Black and Scholes formula when the spot price is 80 dirhams and the strive price is 90 ditams. The inter rate is 6% per year and the maturity is 9 months. The volatility is 40% and the dividend payout is 3%. Provide complete solutions Based on your calculation, how can it be determined whether this option is overpriced or not? For the toolbar, press ALT F10 PC) or ALTFN+F10Mac Paragraph Arial 10pt T. X 533 Questions (50) Demetre premium wat by die and home when the town and the per your and the marty Theo thevided a Provide come on want in whether in 2

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts