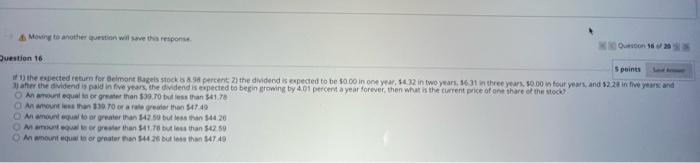

Question: & Moving to another question will save this response. Quesoon 16 of 20 Question 16 5 points if 1) the expected return for Belmont Bagels

& Moving to another question will save this response. Quesoon 16 of 20 Question 16 5 points if 1) the expected return for Belmont Bagels stock is 8.98 percent 2) the dividend is expected to be $0.00 in one year, $4.32 in two years, 16.31 in three years, $0.00 in four years, and $2.28 in five years and 3) after the dividend is paid in five years, the dividend is expected to begin growing by 4.01 percent a year forever, then what is the current price of one share of the stock? O An amount equal to or greater than $39.70 but less than $41.78 O An amount less than $39.70 or a rale greater than $47.49 An amount equal Mamunt equal r greater than $42.50 but less than $44.20 greater than $41.78 but less than $42.59 An amount equal to or greater than $44.26 but less than $47.49

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts