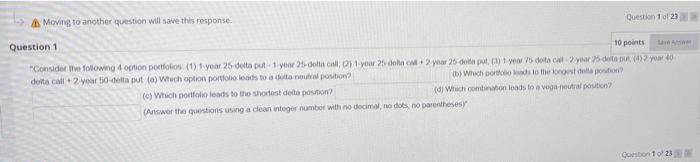

Question: Moving to another question will save this response. Question 1 of 23 Question 1 10 points Save Awe Consider the following 4 option portfolios (1)

Moving to another question will save this response. Question 1 of 23 Question 1 10 points Save Awe "Consider the following 4 option portfolios (1) 1-year 25-delta put-1-year 25-dotta call, (2) 1-year 25-dolta cal+ 2-year 25-della put, (3) 1-year 75 doita cal-2 year 25-delta put, (4)2 your 40 (b) Whech portfolio leads to the longest dela position? delta call +2-year 50-delta put (a) Which option portfolio leads to a duta neutral position? (c) Which portfolio leads to the shortest delta position? (d) Which combination leads to a vega-neutral position? (Answer the questions using a clean integer number with no decimal, no dots, no parentheses) Question 1 of 23 Moving to another question will save this response. Question 1 of 23 Question 1 10 points Save Awe "Consider the following 4 option portfolios (1) 1-year 25-delta put-1-year 25-dotta call, (2) 1-year 25-dolta cal+ 2-year 25-della put, (3) 1-year 75 doita cal-2 year 25-delta put, (4)2 your 40 (b) Whech portfolio leads to the longest dela position? delta call +2-year 50-delta put (a) Which option portfolio leads to a duta neutral position? (c) Which portfolio leads to the shortest delta position? (d) Which combination leads to a vega-neutral position? (Answer the questions using a clean integer number with no decimal, no dots, no parentheses) Question 1 of 23

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts