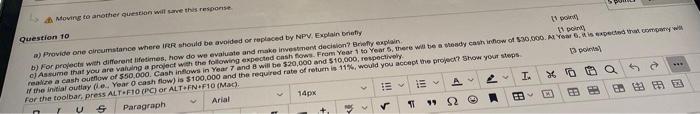

Question: Moving to another question will save this response Question 10 a) Provide one reumstance where IRR should be avoided or replaced by NPV Explain brity

Moving to another question will save this response Question 10 a) Provide one reumstance where IRR should be avoided or replaced by NPV Explain brity 11 poin) b) For protects with different lifetimes, how do we evaluate and make investment decision Briefly explain 11 points c) Assume that you are valuing a project with the following expected cash flows. From Year 1 to Years, there will be a sondy cash how of $20,000. At Yourse will real a cash outflow of $50.000, Cash inflows in Year 7 and will be $20,000 and $10,000, respectively If the initial outtayfie.. Year O cash flow) is $100,000 and the required rate of return is 11%, would you accept the prope? Sow your steps portal For the toolbar, press ALT F10 (PC) or ALTEFNF10 (Mac). U S Paragraph Arial 14px A T. XaQs 199 12 BE EB - BER

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts