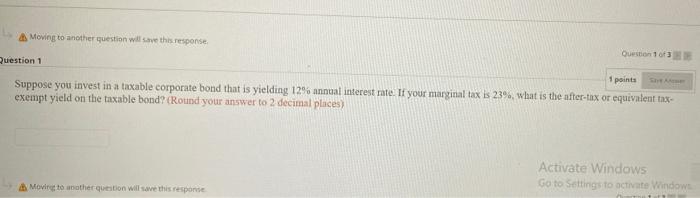

Question: Moving to another question will save this response Question 103 Question 1 1 points Suppose you invest in a taxable corporate bond that is yielding

Moving to another question will save this response Question 103 Question 1 1 points Suppose you invest in a taxable corporate bond that is yielding 12% annual interest rate. If your marginal tax is 23%, what is the after-tax or equivalent tax- exempt yield on the taxable bond? (Round your answer to 2 decimal places) Activate Windows Go to Settings to activate Windows Moving to other question will save this response

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts