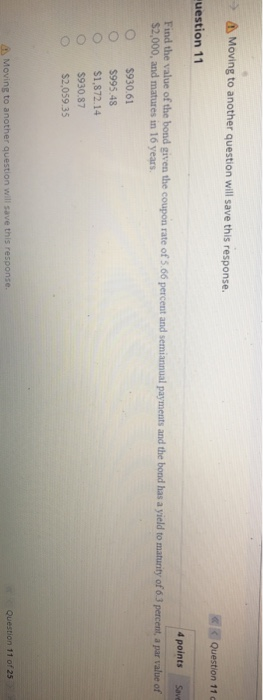

Question: > Moving to another question will save this response. Question 11 uestion 11 4 points Save Find the value of the bond given the coupon

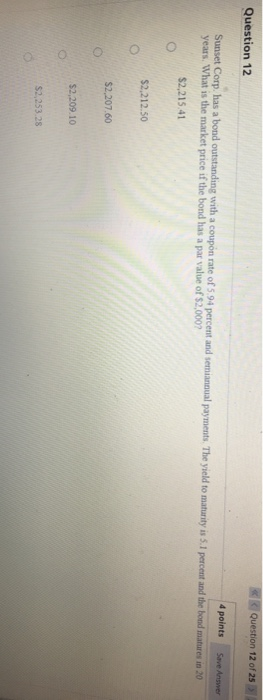

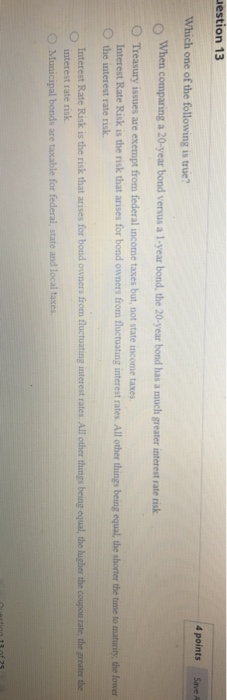

> Moving to another question will save this response. Question 11 uestion 11 4 points Save Find the value of the bond given the coupon rate of 5.66 percent and semiannual payments and the bond has a yield to maturity of 6 3 percent, a par value of $2,000, and matures in 16 years. O $930.61 $995.48 $1.872.14 $930.87 $2,059.35 Moving to another question will save this response. Question 11 of 25 Question 12 Question 12 of 25 4 points Save Answer Sunset Corp. has a bond outstanding with a coupon rate of 5 94 percent and semiannual payments. The yield to maturity is 5.1 percent and the bond matures in 20 years. What is the market price if the bond has a par value of $2,000? $2,215,41 $2,212.50 $2,207.60 $2,209.10 $2,253.28 Gestion 13 4 points Save Which one of the following is true? When comparing a 20-year bond versus a 1-year bond, the 20-year bond has a much greater interest rate risk O Treasury issues are exempt from federal income taxes but not state income taxes Interest Rate Risk is the risk that arises for bond owners from fluctuating interest rates. All other things being equal, the shorter the time to maturity, the lower the interest rate risk Interest Rate Risk is the risk that arises for bond owners from fluctuating interest rates. All other things being equal, the higher the coupon rate, the greater the interest rate risk Municipal bonds are taxable for federal, state and local taxes

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts