Question: Moving to another question will save this response. Question 11 of 20 Question 11 5 points Save Anne The real risk-free rate is expected to

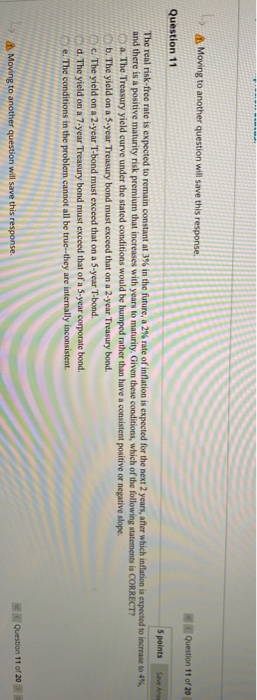

Moving to another question will save this response. Question 11 of 20 Question 11 5 points Save Anne The real risk-free rate is expected to remain constant at 3% in the future, a 2% rate of inflation is expected for the next 2 years, after which inflation is expected to increase to and there is a positive maturity risk premium that increases with years to maturity. Given these conditions, which of the following statements is CORRECT? a. The Treasury yield curve under the stated conditions would be humped rather than have a consistent positive or negative slope. 6. The yield on a 5-year Treasury bond must exceed that on a 2-year Treasury bond. c. The yield on a 2-year T-bond must exceed that on a 5-year T-bond. d. The yield on a 7-year Treasury bond must exceed that of a 5-year corporate bond. e. The conditions in the problem cannot all be true they are internally inconsistent > Question 11 of 20 Moving to another question will save

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts