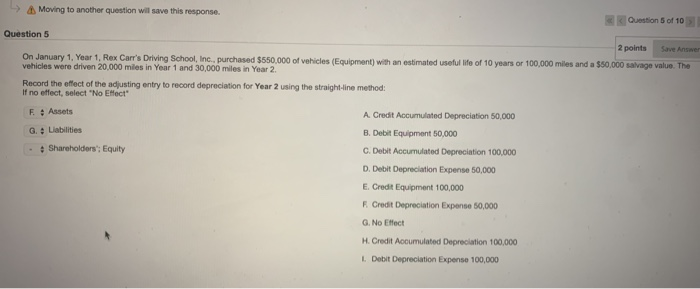

Question: > Moving to another question will save this response. Question 5 of 10 Question 5 2 points On January 1, Year 1, Rex Carr's Driving

> Moving to another question will save this response. Question 5 of 10 Question 5 2 points On January 1, Year 1, Rex Carr's Driving School, Inc., purchased $550,000 of vehicles (Equipment) with an estimated useful life of 10 years or 100,000 miles and a $50,000 salvage value. The vehicles were driven 20.000 miles in Year 1 and 30,000 miles in Year 2 Record the effect of the adjusting entry to record depreciation for Year 2 using the straight-line method If no effect, select "No Elect" F. Assets G. Liabilities Shareholders': Equity A Credit Accumulated Depreciation 50,000 B. Debit Equipment 50,000 C. Debit Accumulated Depreciation 100,000 D. Debit Depreciation Expense 50,000 E Credit Equipment 100,000 F Credit Depreciation Expense 50,000 G. No Effect H. Credit Accumulated Depreciation 100.000 L Debit Depreciation Expense 100,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts