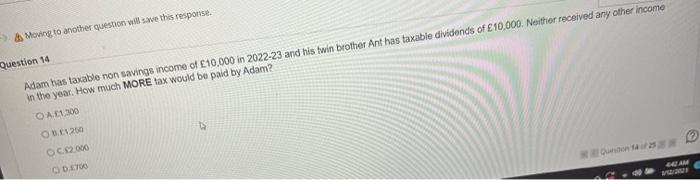

Question: Moving to another question will save this response. Question 14 Adam has taxable non savings income of 10,000 in 2022-23 and his twin brother

Moving to another question will save this response. Question 14 Adam has taxable non savings income of 10,000 in 2022-23 and his twin brother Ant has taxable dividends of 10,000. Neither received any other income in the year. How much MORE tax would be paid by Adam? OA.1,300 OBE1250 OC.2,000 D.700 Question 1425 442 AM 152/2621

Step by Step Solution

3.42 Rating (152 Votes )

There are 3 Steps involved in it

The detailed answer for the above question is provided below This is because Adams taxable nonsaving... View full answer

Get step-by-step solutions from verified subject matter experts