Question: Moving to another question will save this response Question 16 of 30 Question 16 3.4 points Save Ans A company recorded in the current year

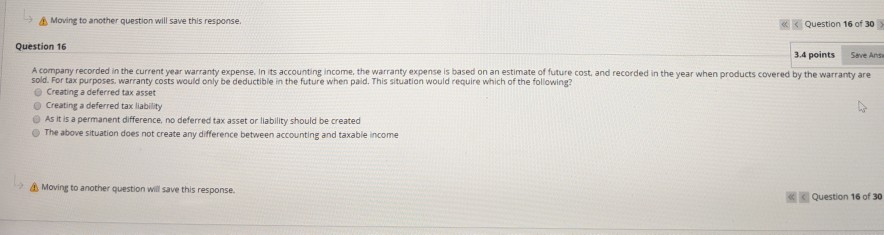

Moving to another question will save this response Question 16 of 30 Question 16 3.4 points Save Ans A company recorded in the current year warranty expense. In its accounting income, the warranty expense is based on an estimate of future cost and recorded in the year when products covered by the warranty are sold. For tax purposes. warranty costs would only be deductible in the future when paid. This situation would require which of the following? Creating a deferred tax asset Creating a deferred tax liability As it is a permanent difference, no deferred tax asset or liability should be created The above situation does not create any difference between accounting and taxable income Moving to another question will save this response. Question 16 of 30

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts