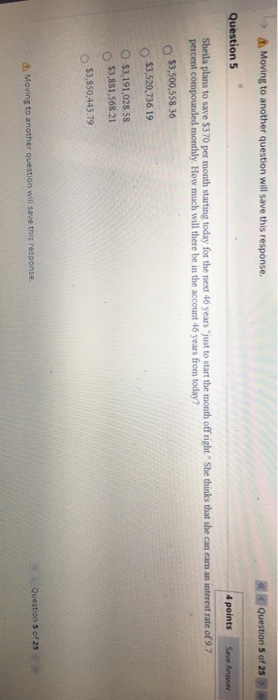

Question: > Moving to another question will save this response. Question 5 of 25 Question 5 4 points Save Answer Sheila plans to save $370 per

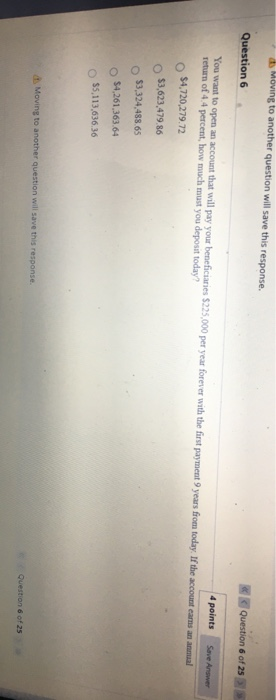

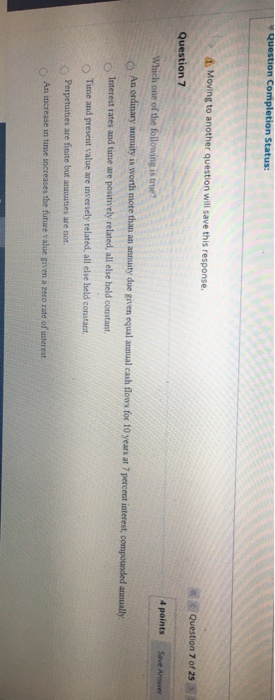

> Moving to another question will save this response. Question 5 of 25 Question 5 4 points Save Answer Sheila plans to save $370 per month starting today for the next 46 years "just to start the month off right." She thinks that she can earn an interest rate of 9.7 percent compounded monthly. How much will there be in the account 46 years from today? $3,500,558.36 $3,520,736.19 $3,191,028.58 $3,881,56821 $3,850.443.79 Question 5 of 25 Moving to another question will save this response. Moving to another question will save this response. Question 6 of 25 Question 6 4 points Soverom You want to open an account that will pay your beneficiaries $225,000 per year forever with the first payment 9 years from today. If the account eams an annual return of 4.4 percent, how much must you deposit today? $4,720,279.72 $3,623.479.86 $3,324,488.65 $4,261,363.64 $5,113,636.36 Moving to another question will save this response Question 6 of 25 Question Completion Status: Moving to another question will save this response. Question 7 of 25 Question 7 4 points Which one of the following is true? Save Answer An ordinary annuity is worth more than an annuity due given equal annual cash flows for 10 years at 7 percent interest.compounded annually Interest rates and time are positively related, all else held constant Time and prevent value are inversely related, all else held constant Perpetuities are finite but annuities are not An increase in tine increases the future value given a zero rate of interest

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts