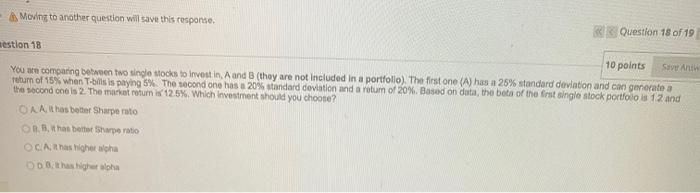

Question: Moving to another question will save this response. Question 18 of 19 mestion 18 10 points Save Ant You un comparing between two single stocks

Moving to another question will save this response. Question 18 of 19 mestion 18 10 points Save Ant You un comparing between two single stocks to invest in A and B (they are not included in a portfolio) The first one (A) has a 25% standard deviation and can generate a return of 15% when T-bills is paying 5%. The second one has a 20% standard deviation and a rotum of 20%. Based on data, the bota of the first single stock portfolios 12 and the second one is 2. The market return is 125%. Which investment should you choose? CA Athos beter Sharpe ruto Oths bete Sharpe ratio OC Athighesha DD thighet

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts