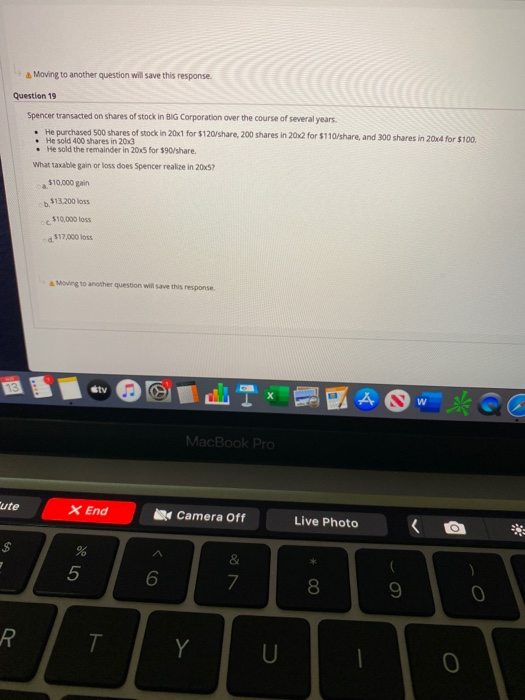

Question: Moving to another question will save this response. Question 19 Spencer transacted on shares of stock in BIG Corporation over the course of several years.

Moving to another question will save this response. Question 19 Spencer transacted on shares of stock in BIG Corporation over the course of several years. He purchased 500 shares of stock in 20x1 for $120/share, 200 shares in 2012 for $110/share, and 300 shares in 20x4 for $100. He sold 400 shares in 2013 He sold the remainder in 2015 for $90/share. What taxable gain or loss does Spencer realize in 20x5? $10,000 gain $13.200 loss c $10,000 loss 517.000 loss Moving to another question will save this response 13 sty W MacBook Pro ute X End x Camera Off Live Photo S % 5 6 7 8 9 0 R T Y U

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts