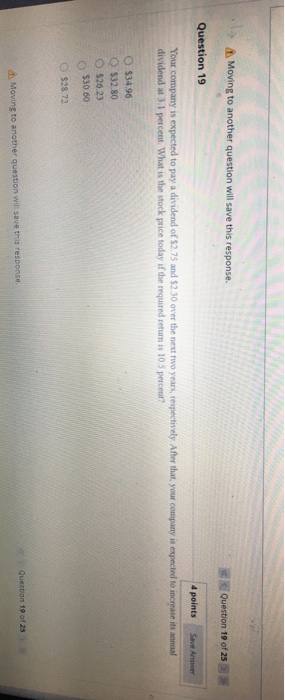

Question: Moving to another question will save this response. Question 19 of 25) Question 19 4 points Save Answer Your company is expected to pay a

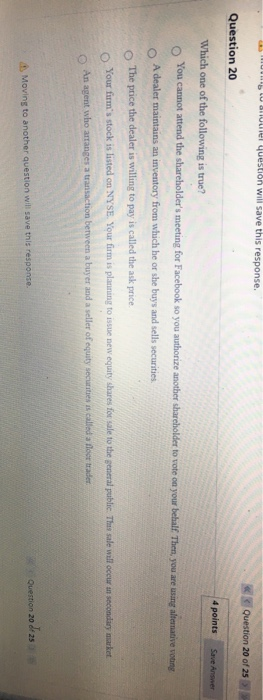

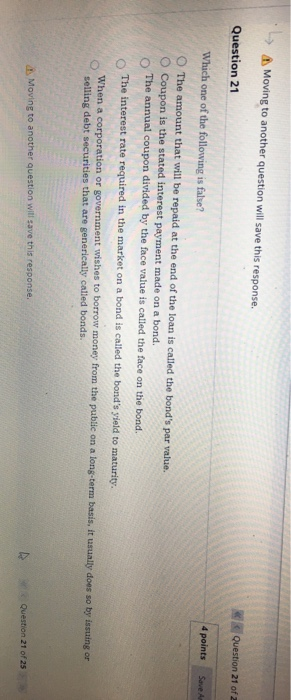

Moving to another question will save this response. Question 19 of 25) Question 19 4 points Save Answer Your company is expected to pay a dividend of $2.75 and $2.30 over the next two years, respectively. After that, your company is expected to increase its anal dividend at 3.1 percent. What is the stock price today if the required return is 105 percent? O $34.96 $32.80 $26.23 $30.60 528 72 Question 19 of 25 Moving to another question will save this response uns anvuel question will save this response. Question 20 of 25 Question 20 4 points Save Answer Which one of the following is true? You cannot attend the shareholder's meeting for Facebook so you authorize another shareholder to vote on your behalf Then, you are using alternative voting A dealer maintains an inventory from which he or she buys and sells securities The price the dealer is willing to pay is called the ask price. Your fum's stock is listed on NYSE. Your firm is planning to issue new equity shares for sale to the general public. This sale will occur in secondary market An agent who arranges a transaction between a buyer and a seller of equity Securities is called a floor trader Moving to another question will save this response. Question 20 de 25 Moving to another question will save this response. Question 21 Question 21 of 2 Which one of the following is false? 4 points Save The amount that will be repaid at the end of the loan is called the bond's par value. Coupon is the stated interest payment made on a bond. The annual coupon divided by the face value is called the face on the bond. The interest rate required in the market on a bond is called the bond's yield to maturity. When a corporation or government wishes to borrow money from the public on a long-term basis, it usually does so by issuing or selling debt securities that are generically called bonds. Moving to another question will save this response. Question 21 of 25

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts