Question: Moving to another question will save this response Question 19 of 2 estion 19 1 points On January 1, 2020, Iniesta Corporation invested in Kasaba

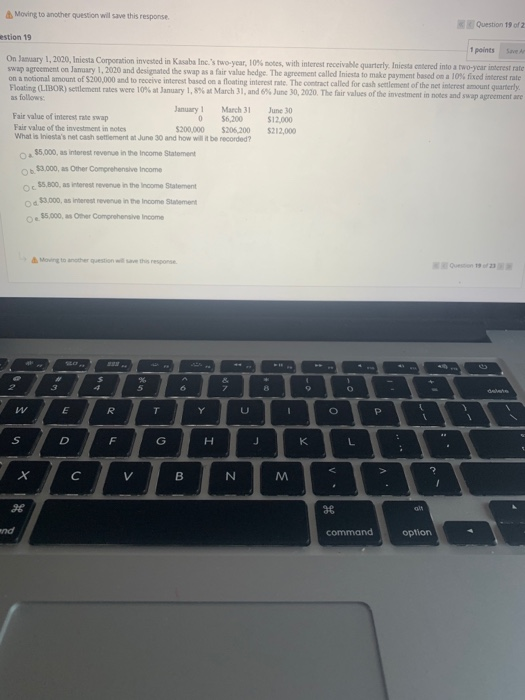

Moving to another question will save this response Question 19 of 2 estion 19 1 points On January 1, 2020, Iniesta Corporation invested in Kasaba Inc.'s two-year, 10% notes, with interest receivable quarterly. Iniesta entered into a two-year interest rate swap agreement on January 1, 2020 and designated the swap as a fair value hedge. The agreement called Iniesta to make payment based on a 10% fixed interest rate on a notional amount of 200,000 and to receive interest based on a floating interest rate. The contract called for cash settlement of the net interest amount quarterly Floating (LIBOR) settlement rates were 10% at January 1,8% at March 31, and 6% June 30, 2000. The fair values of the investment in notes and swap agreementare as follows January March 31 June 30 Fair value of interest rate swap 0 56,200 $12.000 Fair value of the investment in notes $200.000 $206.200 $212,000 What is Iniesta's net cash settlements June 30 and how will it be recorded? $5,000, as interest revenue in the Income Statement $3,000, as Other Comprehensive Income 55,800, as interest revenue in the income Statement $3,000, as interest revenue in the Income Statement $5,000, Other Comprehensive Income & 3 5 E R T Y C 0 P 1 S D F G H J K L A ? X C V B N M V. he G and command option

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts