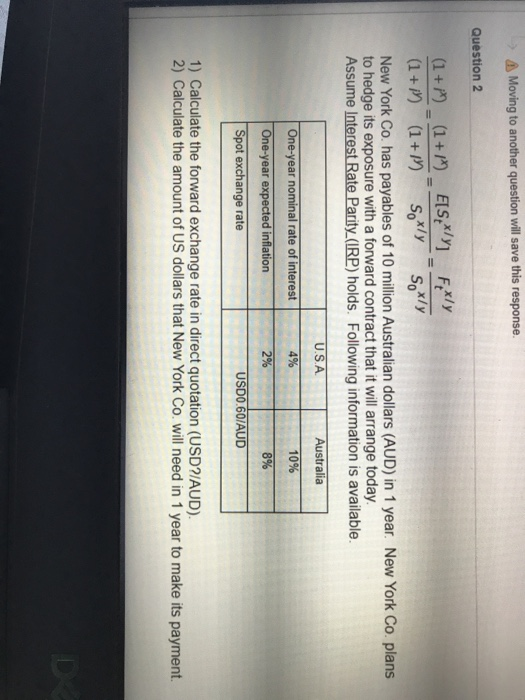

Question: Moving to another question will save this response. Question 2 Soxly (1 + i)_(1+1)_E[S,*/y1 Fixly (1 + (1+1) Sexy New York Co. has payables of

Moving to another question will save this response. Question 2 Soxly (1 + i)_(1+1)_E[S,*/y1 Fixly (1 + (1+1) Sexy New York Co. has payables of 10 million Australian dollars (AUD) in 1 year. New York Co. plans to hedge its exposure with a forward contract that it will arrange today Assume Interest Rate Parity (IRP) holds. Following information is available. U.S.A Australia 4% 10% One-year nominal rate of interest One-year expected inflation 2% 8% Spot exchange rate USD0.60/AUD 1) Calculate the forward exchange rate in direct quotation (USD?/AUD). 2) Calculate the amount of US dollars that New York Co. will need in 1 year to make its payment

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts