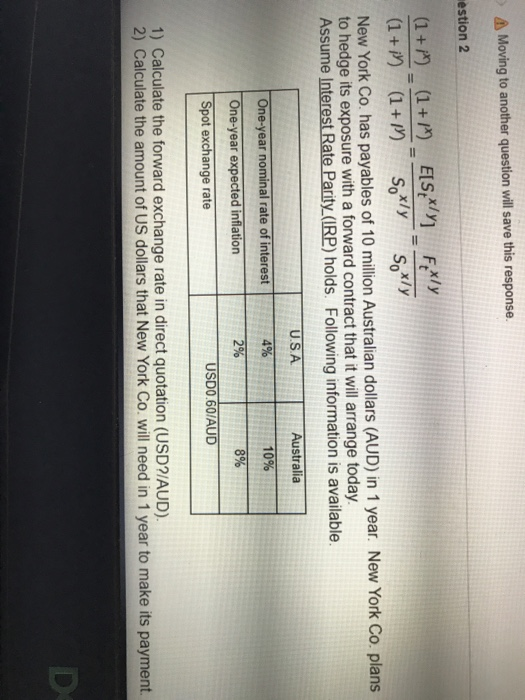

Question: A Moving to another question will save this response. estion 2 Soxly Soxly (1 + i)(1+1)_E[SX/Y]_Fxly (1 + i)(1+1) New York Co. has payables of

A Moving to another question will save this response. estion 2 Soxly Soxly (1 + i)(1+1)_E[SX/Y]_Fxly (1 + i)(1+1) New York Co. has payables of 10 million Australian dollars (AUD) in 1 year. New York Co. plans to hedge its exposure with a forward contract that it will arrange today. Assume Interest Rate Parity_(IRP) holds. Following information is available. U.S.A Australia 4% 10% One-year nominal rate of interest One-year expected inflation Spot exchange rate 2% 8% USD0.60/AUD 1) Calculate the forward exchange rate in direct quotation (USD?/AUD). 2) Calculate the amount of US dollars that New York Co. will need in 1 year to make its payment. D

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts