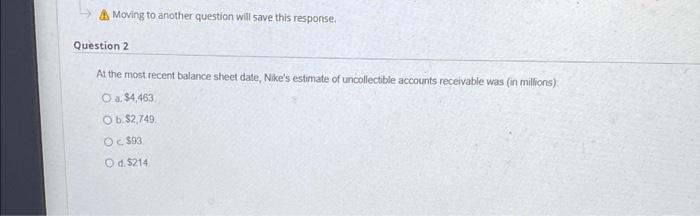

Question: Moving to another question will save this response. Question 2 At the most recent balance sheet date, Nike's estimate of uncollectible accounts receivable was (in

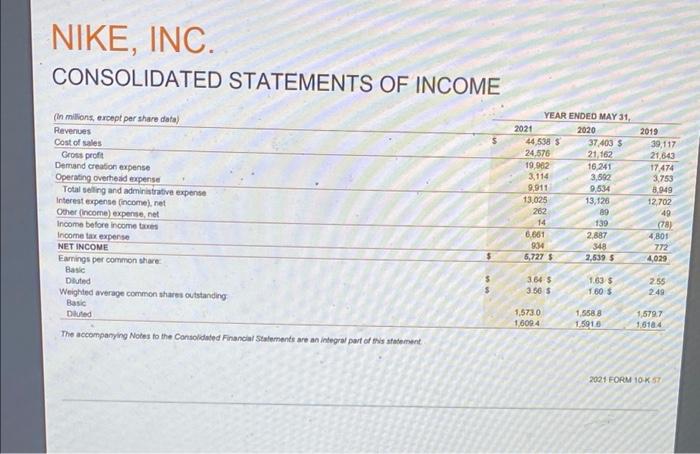

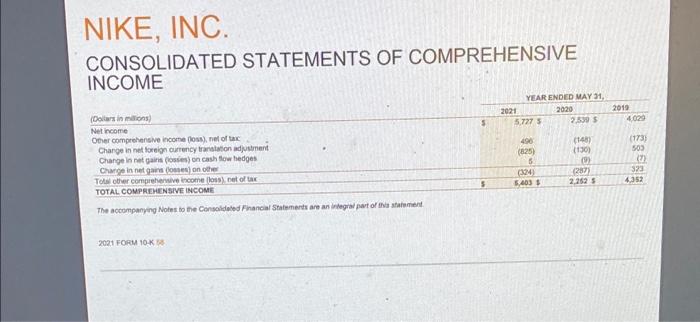

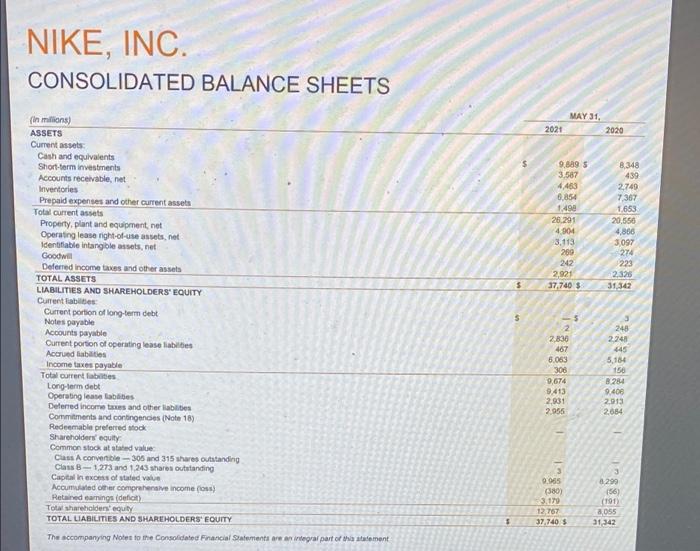

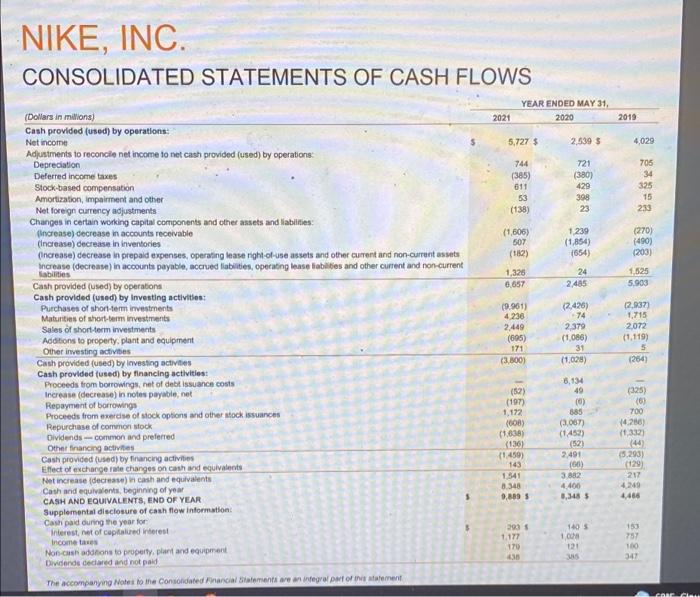

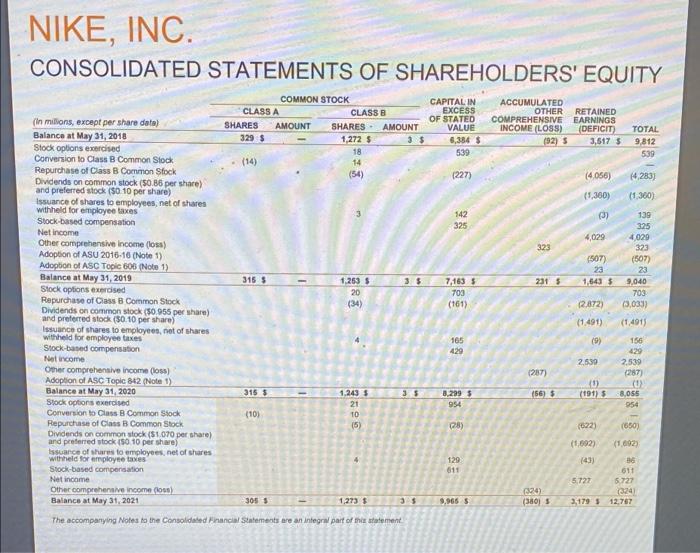

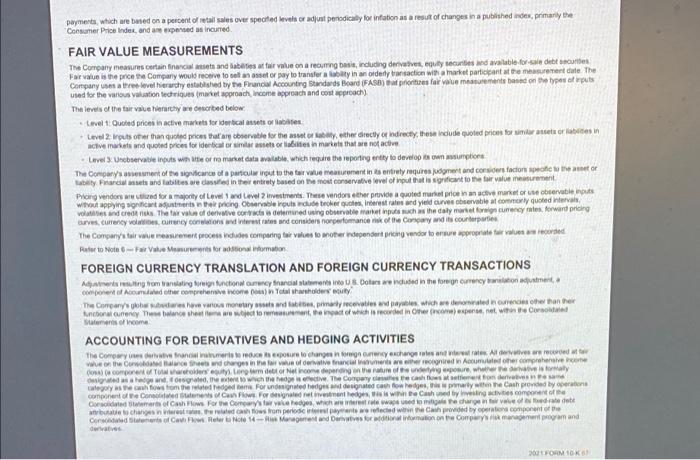

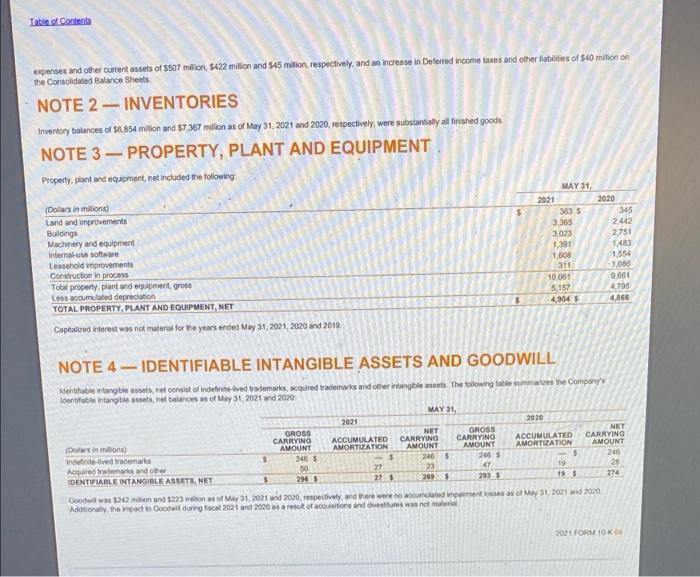

Moving to another question will save this response. Question 2 At the most recent balance sheet date, Nike's estimate of uncollectible accounts receivable was (in millions): O a. $4,463 O b. $2,749. Oc $93 O d. $214 NIKE, INC. CONSOLIDATED STATEMENTS OF INCOME (in millions, except per share data) 2021 Revenues Cost of sales Gross profit Demand creation expense Operating overhead expense Total selling and administrative expense Interest expense (income), net Other (income) expense, net Income before income taxes Income tax expense NET INCOME Earnings per common share Basic Diluted Weighted average common shares outstanding Basic Diluted The accompanying Notes to the Consolidated Financial Statements are an integral part of this statement $ YEAR ENDED MAY 31, 2020 37,403 S 21,162 16,241 3,592 9,534 13,126 89 139 2,887 348 2,539 S 1.63 $ 1.60 $ 44,538 $ 24,576 19,902 3,114 9,911 13,025 262 14 6,661 934 5,727 S 3.64 $ 3.50 $ 1,573.0 1,6094 2019 1,558.8 1.591.6 39,117 21,643 17,474 3,753 8,949 12,702 49 (78) 4,801 772 4,029 2.55 249 1,579.7 1.6184 2021 FORM 10-K 57 NIKE, INC. CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME YEAR ENDED MAY 31, 2020 (Dollars in millions) 2021 2,539 S Net income Other comprehensive income (loss), net of tax Change in net foreign currency translation adjustment (148) (130) Change in net gains (lossies) on cash flow hedges Change in net gains (osses) on other (9) (287) Total other comprehensive income (loss), net of tax 2,262 S TOTAL COMPREHENSIVE INCOME The accompanying Notes to the Consolidated Financial Statements are an integral part of this statement 2021 FORM 10-K 5 5,727 S 496 (825) 6 (324) 5,403 $ 2019 4,029 (173) 503 (7) 323 4,352 NIKE, INC. CONSOLIDATED BALANCE SHEETS (in millions) ASSETS Current assets Cash and equivalents Short-term investments Accounts receivable, net Inventories Prepaid expenses and other current assets Total current assets Property, plant and equipment, net Operating lease right-of-use assets, net Identifiable intangible assets, net Goodwill Deferred income taxes and other assets TOTAL ASSETS LIABILITIES AND SHAREHOLDERS' EQUITY Current liabiles Current portion of long-term debt Notes payable Accounts payable Current portion of operating lease liabilities Accrued abilities Income taxes payable Total current liabilities Long-term debt Operating lease lablites Deferred income taxes and other liabilities Commitments and contingencies (Note 18) Redeemable preferred stock Shareholders' equity Common stock at stated value: Class A convertible-305 and 315 shares outstanding Class 8-1,273 and 1,243 shares outstanding Capital in excess of stated value. Accumulated other comprehensive income (los) Retained earnings (deficit) Total shareholders' equity TOTAL LIABILITIES AND SHAREHOLDERS' EQUITY The accompanying Notes to the Consolidated Financial Statements are an integral part of this statement S $ $ 2021 9,889 S 3,587 4,463 6,854 1.498 26.291 4,904 3,113 269 242 2,921 37,740 $ 2 2,830 467 6,063 306 MAY 31, 9,674 9,413 2,931 2.955 9.965 (380) 3.179 12,767 37,740 2020 8,348 439 2,749 7,367 1,653 20,550 4,866 3,097 274 223 2.326 31,342 248 2,248 445 5,184 156 8,284 9,406 2.913 2,684 8.299 (56) (191) 8,055 31,342 NIKE, INC. CONSOLIDATED STATEMENTS OF CASH FLOWS (Dollars in millions) 2021 Cash provided (used) by operations: Net income Adjustments to reconcile net income to net cash provided (used) by operations: Depreciation Deferred income taxes Stock-based compensation Amortization, impairment and other Net foreign currency adjustments Changes in certain working capital components and other assets and liabilities: (increase) decrease in accounts receivable (Increase) decrease in inventories (Increase) decrease in prepaid expenses, operating lease right-of-use assets and other current and non-current assets increase (decrease) in accounts payable, accrued liabilities, operating lease liabilities and other current and non-current labilities Cash provided (used) by operations Cash provided (used) by investing activities: Purchases of short-term investments Maturities of short-term investments Sales of short-term investments Additions to property, plant and equipment Other investing activities Cash provided (used) by investing activities Cash provided (used) by financing activities: Proceeds from borrowings, net of debt issuance costs Increase (decrease) in notes payable, net Repayment of borrowings Proceeds from exercise of stock options and other stock issuances Repurchase of common stock Dividends common and preferred Other financing activites Cash provided (used) by financing activities Effect of exchange rate changes on cash and equivalents Net increase (decrease) in cash and equivalents Cash and equivalents, beginning of year CASH AND EQUIVALENTS, END OF YEAR Supplemental disclosure of cash flow information: Cash paid during the year for Interest, net of capitalized interest Income taxes Non-cash additions to property, plant and equipment Dividends declared and not paid The accompanying Notes to the Consolidated Financial Statements are an integral part of this statement S $ YEAR ENDED MAY 31, 2020 2,539 S 721 (380) 429 398 5,727 $ 744 (385) 611 53 (138) (1,606) 507 (182) 1,326 6,657 (9.961) 4,236 2,449 (695) 171 (3,800) (52) (197) 1,172 (608) (1.638) (136) (1,459) (143) 1,541 8.348 9,889 S 293 1 1.177 170 438 23 1,239 (1,854) (654) 24 2,485 (2,426) +74 2,379 (1,086) 31 (1.028) 6,134 49 (0) 685 (3,067) (1452) (52) 2,491 3,882 4,400 8,348 (60) 140 $ 1,028 121 385 2019 4,029 705 34 325 15 233 (270) (490) (203) 1,525 5.903 (2,937) 1,715 2,072 (1,119) (264) (325) (6) 700 (4.286) (1,332) (44) (5.293) (129) 217 4,249 4,466 153 757 100 347 Claw NIKE, INC. CONSOLIDATED STATEMENTS OF SHAREHOLDERS' EQUITY COMMON STOCK CAPITAL IN ACCUMULATED CLASS A EXCESS OF STATED VALUE CLASS B SHARES AMOUNT 1,272 S 3 $ OTHER RETAINED COMPREHENSIVE EARNINGS INCOME (LOSS) (in millions, except per share data) Balance at May 31, 2018 Stock options exercised SHARES AMOUNT 329 S (DEFICIT) TOTAL (92) s 3,617 $ 9,812 6,384 $ 539 18 539 (14) 14 Conversion to Class B Common Stock Repurchase of Class B Common Stock Dividends on common stock (50.86 per share) and preferred stock ($0.10 per share) (54) (227) (4,283) (1,360) Issuance of shares to employees, net of shares withheld for employee taxes 142 139 Stock-based compensation 325 325 Net income 4,029 323 Other comprehensive income (loss) Adoption of ASU 2016-16 (Note 1) Adoption of ASC Topic 606 (Note 1) Balance at May 31, 2019 (507) 23 7,163 Stock options exercised 1,263 S 20 (34) Repurchase of Class B Common Stock Dividends on common stock ($0.955 per share) and preferred stock ($0.10 per share) Issuance of shares to employees, net of shares withheld for employee taxes Stock-based compensation Net income Other comprehensive income (loss) Adoption of ASC Topic 842 (Note 1) Balance at May 31, 2020 1.243 S Stock options exercised 315 $ (10) 21 Conversion to Class B Common Stock 10 (5) Repurchase of Class B Common Stock Dividends on common stock ($1.070 per share) and preferred stock ($0.10 per share) Issuance of shares to employees, net of shares withheld for employee taxes Stock-based compensation Net income Other comprehensive income (loss) 305 S 1,273 $ Balance at May 31, 2021 35 The accompanying Notes to the Consolidated Financial Statements are an integral part of this statement 315 S - 35 35 703 (161) 165 429 8,299 $ 954 (28) 129 611 9,965 S 323 231 S (287) (56) $ (324) (380) (4,056) (1,360) (3) 4,029 (507) 23 1,643 (2.872) (1.491) (9) 2,539 (5) (191) S (622) (1,692) (43) 5,727 3,179 S 9,040 703 (3,033) (1,491) 156 429 2,539 (287) (1) 8,055 954 (650) (1,092) 86 611 5,727 (324) 12,767 payments, which are based on a percent of retail sales over specified levels or adjust periodically for inflation as a result of changes in a published indes, primarily the Consumer Price Index, and are expensed as incurred. FAIR VALUE MEASUREMENTS The Company measures certain financial assets and liabilities at fair value on a recurring basis, including derivatives, equity securities and available-for-sale debt securities Fair value is the price the Company would receive to sell an asset or pay to transfer a lability in an ordently transaction with a market participant at the measurement date. The Company uses a three-level hierarchy established by the Financial Accounting Standards Board (FASB) that prioritizes fair value measurements based on the types of inputs used for the various valuation techniques (market approach, income approach and cost approach) The levels of the tair value hierarchy are described below Level 1: Quoted prices in active markets for identical assets or lates Level 2: Inputs other than quoted prices that are observable for the asset or Sability, either directly or indirectly, these include quoted prices for similar assets or liabides in active markets and quoted prices for identical or similar assets or liabites in markets that are not active -Level 3: Unobservable inputs with little or no market data available, which require the reporting entity to develop its own assumptions The Company's assessment of the significance of a particular input to the fair value measurement in its entirety requires judgment and considers factors specific to the asset or Sability Financial assets and labilities are classified in their entirety based on the most conservative level of input that is significant to the fair value measurement Pricing vendors are utilized for a majority of Level 1 and Level 2 investments. These vendors either provide a quoted market price in an active market or use observable inputs without applying significant adjustments in their pricing. Observable inputs include broker quotes, interest rates and yield curves observable at commonly quoted intervals, volatilities and credit risks. The fair value of derivative contracts is determined using observable market inputs such as the daily market foreign currency rates, forward pricing curves, currency volaties, currency corelations and interest rates and considers norperformance risk of the Company and its counterparties The Company's fair value measurement process includes comparing fair values to another independent pricing vendor to ensure appropriate fair values are recorded Rater to Note 6-Fair Value Measurements for additional information FOREIGN CURRENCY TRANSLATION AND FOREIGN CURRENCY TRANSACTIONS Adjustments resulting from translating foreign functional currency financial statements into US Dollars are included in the foreign currency translation adjustment, component of Accumulated other comprehensive income poss) in Total shareholders equity The Company's global subedanes have vanous monetary assets and Sabetes, primarily receivables and payables, which are denominated in ourencies other than their functional currency. These balance sheet items are subject to remeasurement, the impact of which is recorded in Other (income) expense, net, within the Corsoldad Statements of income ACCOUNTING FOR DERIVATIVES AND HEDGING ACTIVITIES The Company uses derivative financial instruments to reduce its exposure to changes in foreign currency exchange rates and interest rates All derivatives are recorded at tai value on the Consolidated Balance Sheets and changes in the fair value of denvative financial instruments are either recognized in Accumulated other comprehensive conte (oss) (a component of Total shareholders equity). Long term debit or Net income depending on the nature of the underlying exposure, whether the derative is formaty designated as a hedge and designated, the extent to which the hedge is effective. The Company classes the cash flows a at settement from derivates category as the cash flows from the related hedged items For undesignated hedges and designated cash flow hedges, this is primarily within the Cash provided by operations component of the Consolidated Statements of Cash Flows. For designated net investment hedges, this is within the Cash used by investing activities component of the Consolidated Statements of Cash Flows For the Company's fair value hedges, which are interest rate swaps used to mitigate the change in their value of sedrate dete atributable to changes in interest rates, the related cash flows from periodic interest payments are reflected within the Clash provided by operations component of the Consondated Statements of Cash Flows Refer to Note 14-Russ Management and Derivatives for additional information on the Company's risk management program and derivatives 2021 FORM 10-K6 Table of Contents expenses and other current assets of $507 million, $422 million and $45 million, respectively, and an increase in Deferred income taxes and other liabilities of $40 milion on the Consolidated Balance Sheets NOTE 2-INVENTORIES Inventory balances of $6,854 million and $7,367 million as of May 31, 2021 and 2020, respectively, were substantially all finished goods. NOTE 3 PROPERTY, PLANT AND EQUIPMENT Property, plant and equipment, net included the following MAY 31, (Dollars in millions) 363 5 345 Land and improvements 2,442 Buildings 2,751 Machinery and equipment 1,483 Internal-use software 1,554 Leasehold improvements 1,066 Construction in process 10.061 9,661 Total property, plant and equipment, gross 5,157 4,795 Less accumulated depreciation $ 4,904 4,866 TOTAL PROPERTY, PLANT AND EQUIPMENT, NET Capitalized interest was not material for the years ended May 31, 2021, 2020 and 2019. NOTE 4-IDENTIFIABLE INTANGIBLE ASSETS AND GOODWILL Identifiable intangible assets, net consist of indefinite-lived trademarks, acquired trademarks and other intangible assets. The following table summarizes the Company's Identifiable intangible assets, net balances as of May 31, 2021 and 2020: MAY 31, 2020 2021 NET (Dollars in millions) GROSS CARRYING AMOUNT 240 5 ACCUMULATED AMORTIZATION NET GROSS CARRYING CARR ACCUMULATED AMOUNT AMOUNT AMORTIZATION 246 $ 240 S 19 47 23 19 S $ CARRYING AMOUNT 240 $ Indefinite-lived trademarks $ 27 27 S 28 Acquired trademarks and other 50 296 IDENTIFIABLE INTANGIBLE ASSETS, NET 274 269 $ 293 S Goodwill was $242 million and $223 million as of May 31, 2021 and 2020, respectively, and there were no accumulated impairment losses as of May 31, 2021 and 2020 Additionally, the impact to Goodwill during fiscal 2021 and 2020 as a result of acquisitions and divestitures was not material 2021 FORM 10-K0 S 2021 3,365 3,023 1,391 1,608 311 2020

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts