Question: Moving to another question will save this response. Question 2 of 5 Question 2 20 points Save Answer As a junior financial analyst at Houliahn

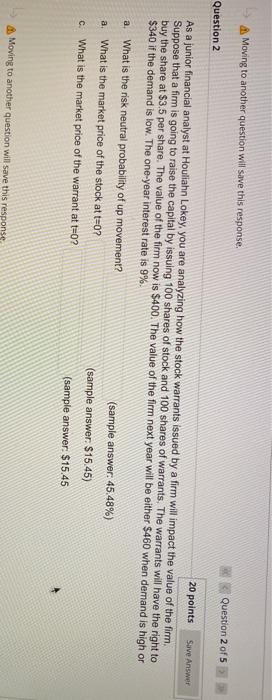

Moving to another question will save this response. Question 2 of 5 Question 2 20 points Save Answer As a junior financial analyst at Houliahn Lokey, you are analyzing how the stock warrants issued by a firm will impact the value of the firm, Suppose that a firm is going to raise the capital by issuing 100 shares of stock and 100 shares of warrants. The warrants will have the right to buy the share at $3.5 per share. The value of the firm now is $400. The value of the firm next year will be either $460 when demand is high or $340 if the demand is low. The one-year interest rate is 9% a. What is the risk neutral probability of up movement? (sample answer: 45.48%) a. What is the market price of the stock at t=0? (sample answer $15.45) c. What is the market price of the warrant at t=0? (sample answer: $15.45 Moving to another question will save this response

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts