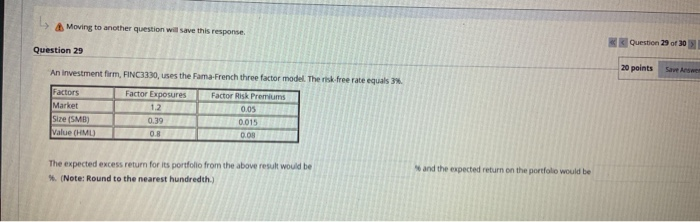

Question: Moving to another question will save this response Question 29 of 30 Question 29 An Investment firm, FINC3330, uses the Fama French three factor model.

Moving to another question will save this response Question 29 of 30 Question 29 An Investment firm, FINC3330, uses the Fama French three factor model. The risk free rate equals 3% 20 points Save Answer Factors Market Size (MB) Value (HML) Factor Exposures 1.2 0.39 0.8 Factor Risk Premiums 0.05 0.015 0.08 The expected excess return for its portfolio from the above result would be %. (Note: Round to the nearest hundredth) and the expected return on the portfolio would be

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts